Question: 7. Would it be appropriate to include selling and administrative expenses in either manufacturing overhead or cost of goods sold? Yes or No Required Information

7. Would it be appropriate to include selling and administrative expenses in either manufacturing overhead or cost of goods sold?

Yes or No

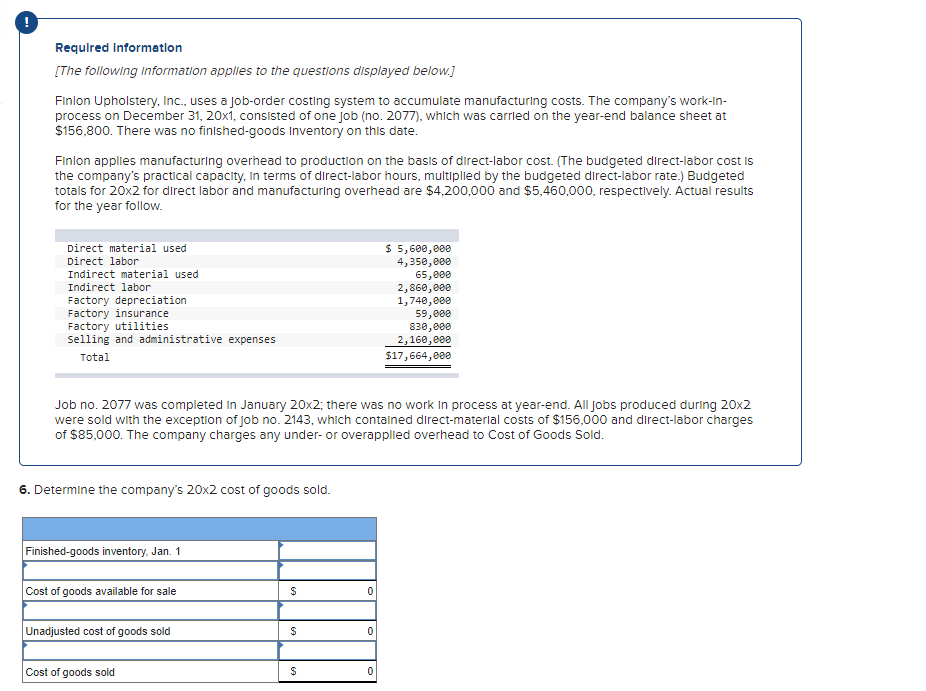

Required Information [The following Information applies to the questions displayed below.] Finlon Upholstery, Inc., uses a job-order costing system to accumulate manufacturing costs. The company's work-Inprocess on December 31,201, consisted of one job (no. 2077), which was carrled on the year-end balance sheet at $156,800. There was no finlshed-goods Inventory on this date. Finlon applies manufacturing overhead to production on the basis of direct-labor cost. (The budgeted direct-labor cost Is the company's practical capacity, In terms of dlrect-labor hours, multiplled by the budgeted direct-labor rate.) Budgeted totals for 202 for direct labor and manufacturing overhead are $4,200,000 and $5,460,000, respectlvely. Actual results for the year follow. Job no. 2077 was completed In January 20x2; there was no work in process at year-end. All Jobs produced during 202 were sold with the exception of job no. 2143 , which contained direct-materlal costs of $156,000 and direct-labor charges of $85,000. The company charges any under- or overapplied overhead to Cost of Goods Sold. 6. Determine the company's 202 cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts