Question: 7. Would you accept a project that is expected to pay $2,500 per year for 6 years if the initial investment is $10,000 and your

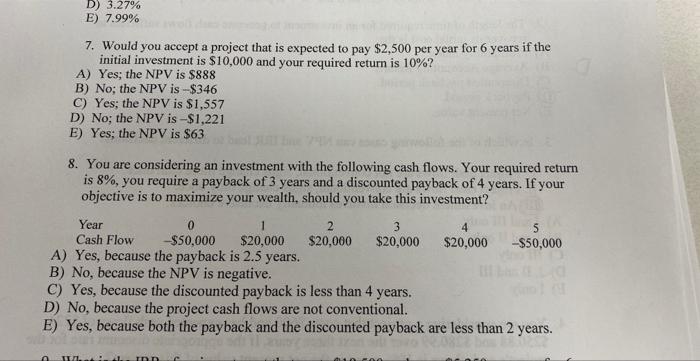

7. Would you accept a project that is expected to pay $2,500 per year for 6 years if the initial investment is $10,000 and your required return is 10% ? A) Yes; the NPV is $888 B) No; the NPV is $346 C) Yes; the NPV is $1,557 D) No; the NPV is $1,221 E) Yes; the NPV is $63 8. You are considering an investment with the following cash flows. Your required return is 8%, you require a payback of 3 years and a discounted payback of 4 years. If your objective is to maximize your wealth, should you take this investment? A) 1 cs, vecause me payouck is z.s years. B) No, because the NPV is negative. C) Yes, because the discounted payback is less than 4 years. D) No, because the project cash flows are not conventional. E) Yes, because both the payback and the discounted payback are less than 2 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts