Question: 7. You are a financial planner advising a client on her retirement. She wants to have sufficient funds in retirement so that she will

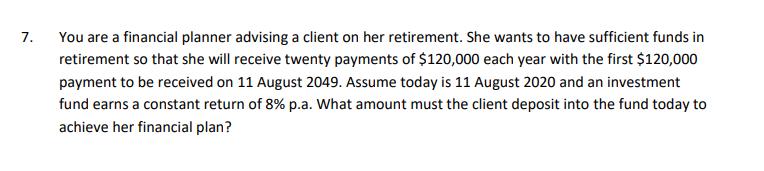

7. You are a financial planner advising a client on her retirement. She wants to have sufficient funds in retirement so that she will receive twenty payments of $120,000 each year with the first $120,000 payment to be received on 11 August 2049. Assume today is 11 August 2020 and an investment fund earns a constant return of 8% p.a. What amount must the client deposit into the fund today to achieve her financial plan?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

To calculate the present value of the retirement payments we can use the formu... View full answer

Get step-by-step solutions from verified subject matter experts