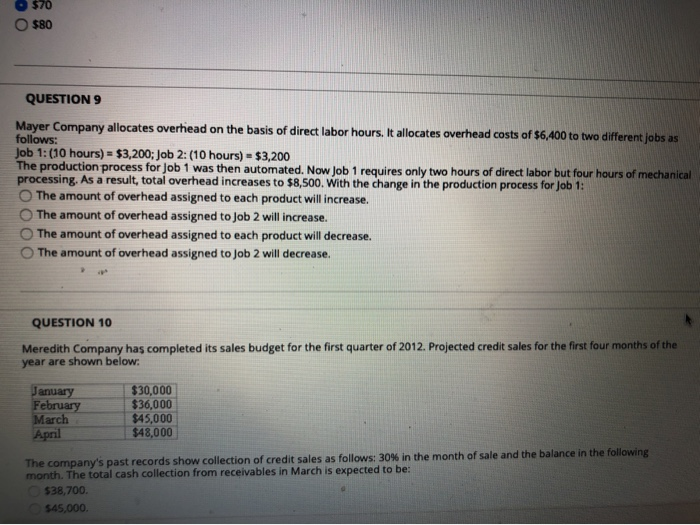

Question: $70 $80 QUESTION 9 Mayer Company allocates overhead on the basis of direct labor hours. It allocates overhead costs of $6,400 to two different jobs

$70 $80 QUESTION 9 Mayer Company allocates overhead on the basis of direct labor hours. It allocates overhead costs of $6,400 to two different jobs as follows: Job 1: (10 hours) = $3,200; Job 2: (10 hours) - $3,200 The production process for Job 1 was then automated. Now Job 1 requires only two hours of direct labor but four hours of mechanical processing. As a result, total overhead increases to $8,500. With the change in the The amount of overhead assigned to each product will increase. The amount of overhead assigned to Job 2 will increase. The amount of overhead assigned to each product will decrease. The amount of overhead assigned to Job 2 will decrease. QUESTION 10 Meredith Company has completed its sales budget for the first quarter of 2012. Projected credit sales for the first four months of the year are shown below: January February March April $30,000 $36,000 $45,000 $48,000 The company's past records show collection of credit sales as follows: 30% in the month of sale and the balance in the followin month. The total cash collection from receivables in March is expected to be: 538,700 $45,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts