Question: 7-1 Define the following terms, using graphs or equations to illustrate your answers wherever feasible: 2. Stand-alone risk risk, probability distribution b. Expected rate of

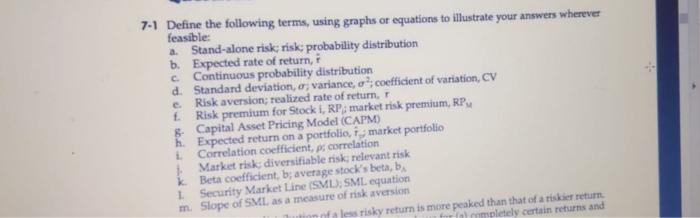

7-1 Define the following terms, using graphs or equations to illustrate your answers wherever feasible: 2. Stand-alone risk risk, probability distribution b. Expected rate of return, i Continuous probability distribution d. Standard deviation, ovariance, of coefficient of variation, CV Risk aversion; realized rate of return, Risk premium for Stock I, RP, market risk premium, RPM & Capital Asset Pricing Model (CAPM) h. Expected return on a portfolio, is market portfolio Correlation coefficient, pscorrelation Market risk diversifiable risks relevant risk k Beta coefficient, b; average stock's beta, b 1 Security Market Line (SMU), SML equation m Slope of SML as a measure of risk version risky return is more peaked than that of a risker return ompletely certain returns and Assume that the risk-free rate is 5% and the market risk premium is 6%. What is the expected return for the overall stock market? What is the required rate of return on a stock that has a beta of 1.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts