Question: Problem 3 A. Determine when a cash flow model is an appropriate model to value companies? (2 Marks) B. Discuss investment situations when using

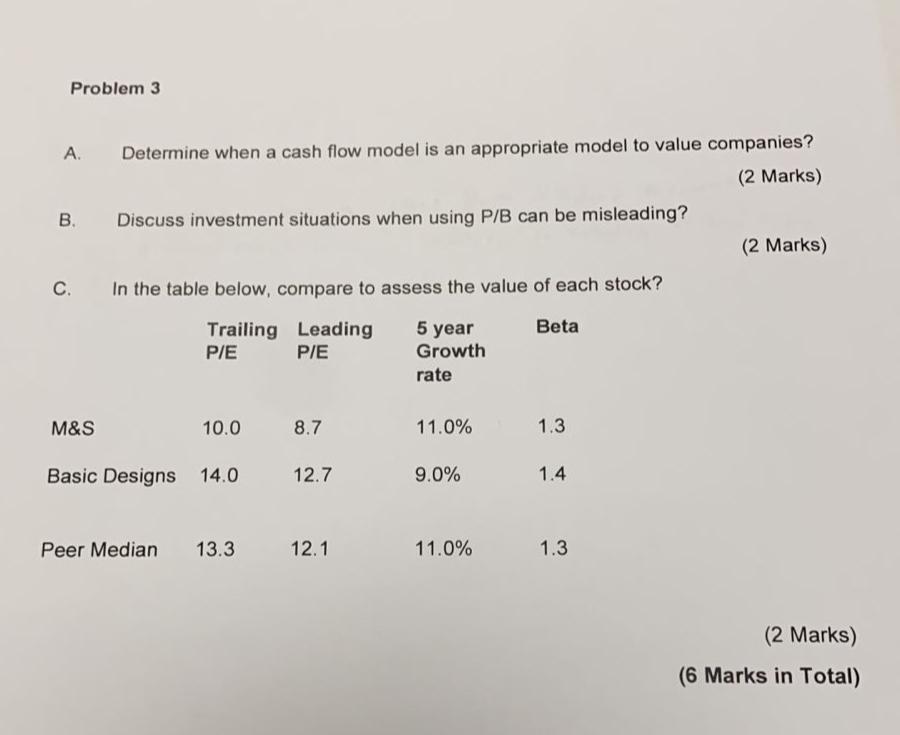

Problem 3 A. Determine when a cash flow model is an appropriate model to value companies? (2 Marks) B. Discuss investment situations when using P/B can be misleading? C. In the table below, compare to assess the value of each stock? Trailing Leading P/E P/E M&S 10.0 8.7 Basic Designs 14.0 Peer Median 13.3 12.7 12.1 5 year Growth rate 11.0% 9.0% 11.0% Beta 1.3 1.4 1.3 (2 Marks) (2 Marks) (6 Marks in Total)

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

A Discounted cash flow models are widely used by analysts to value companies Cash flow modelling ena... View full answer

Get step-by-step solutions from verified subject matter experts