Question: 7.1- *PLEASE ANSWER ALL 5 QUESTIONS* 5 multiple choice questions. 1. 2. 3. 4. 5. The net realizable value of accounts receivable decreases when an

7.1-*PLEASE ANSWER ALL 5 QUESTIONS*

5 multiple choice questions.

1.

2.

3.

4.

5.

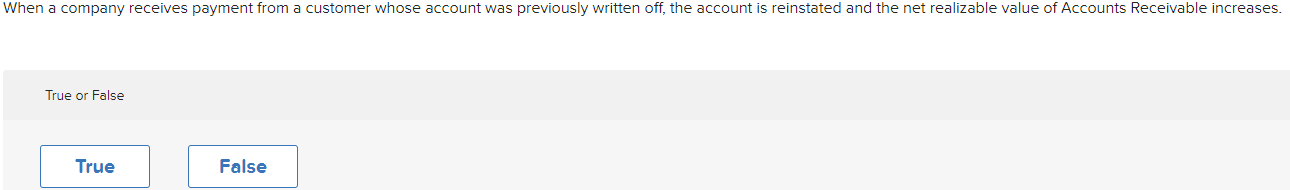

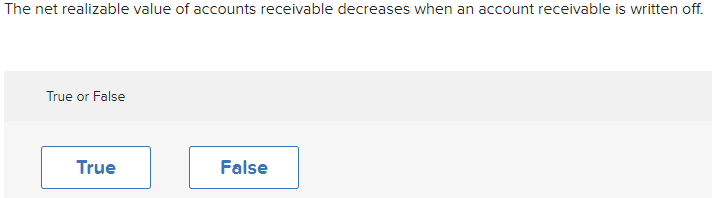

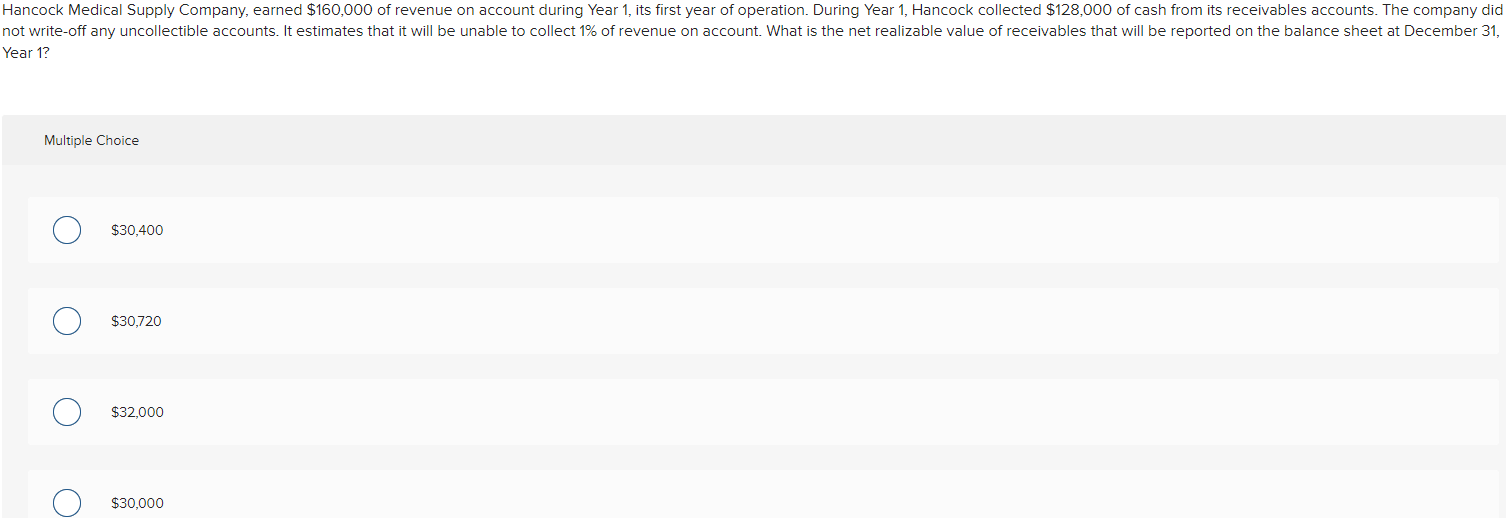

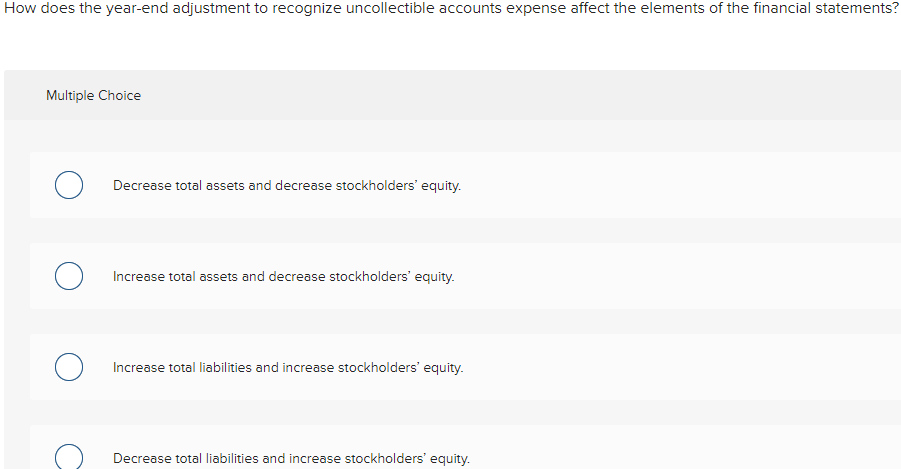

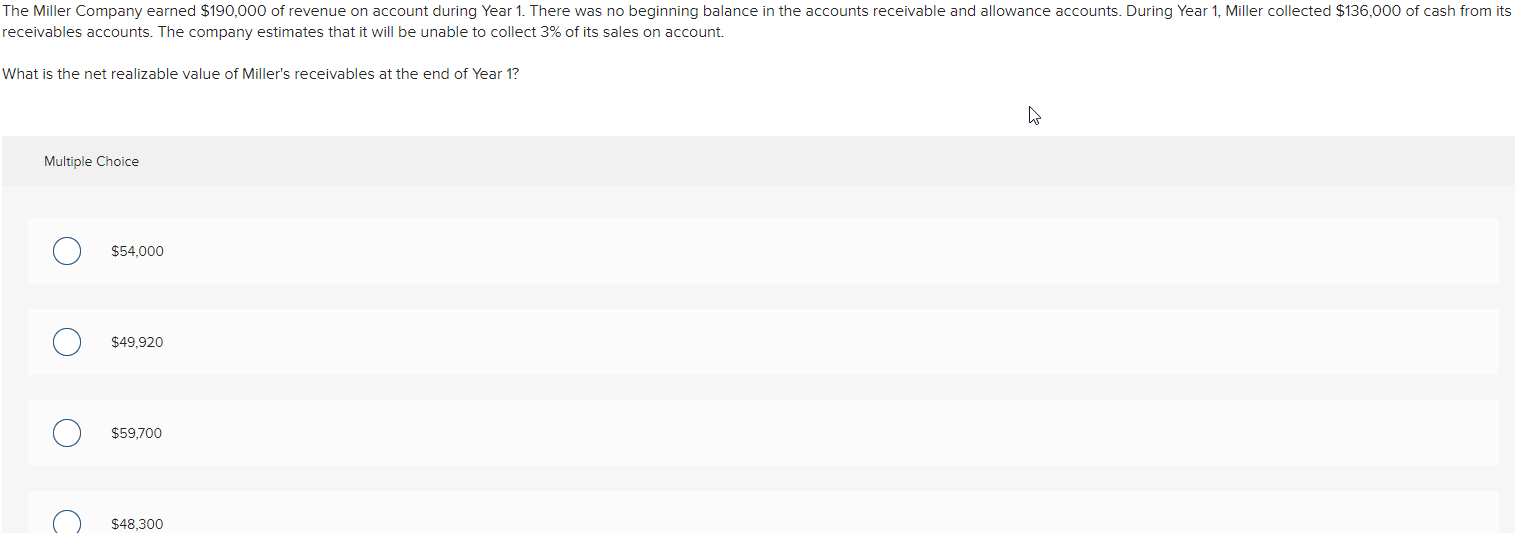

The net realizable value of accounts receivable decreases when an account receivable is written off. True or False Year 1? Multiple Choice $30,400 $30,720 $32,000 $30,000 When a company receives payment from a customer whose account was previously written off, the account is reinstated and the net realizable value of Accounts Receivable increases. True or False low does the year-end adjustment to recognize uncollectible accounts expense affect the elements of the financial statements? Multiple Choice Decrease total assets and decrease stockholders' equity. Increase total assets and decrease stockholders' equity. Increase total liabilities and increase stockholders' equity. Decrease total liabilities and increase stockholders' equity. eceivables accounts. The company estimates that it will be unable to collect 3% of its sales on account. Vhat is the net realizable value of Miller's receivables at the end of Year 1? Multiple Choice $54,000 $49,920 $59,700 $48,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts