Question: 71) The expected risk premium on a stock is equal to the expected return on the stock minus 71 the: A) risk-free rate. B) variance.

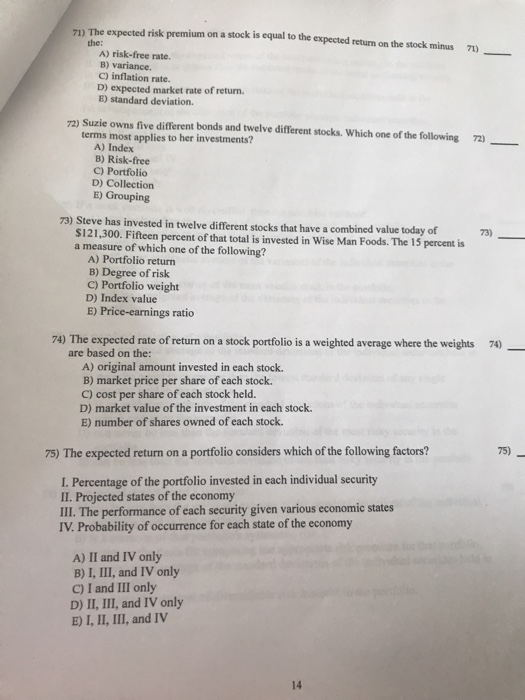

71) The expected risk premium on a stock is equal to the expected return on the stock minus 71 the: A) risk-free rate. B) variance. c) inflation rate. D) expected market rate of return. E) standard deviation 72) Suzie owns five different bonds and twelve different stocks. Which one of the following terms most applies to her investments? A) Index B) Risk-free C) Portfolio D) Collection 72) E) Grouping 73) Steve has invested in twelve different stocks that have a combined value today of $121,300. Fifteen percent of that total is invested in Wise Man Foods. The 15 percent is a measure of which one of the following? A) Portfolio return B) Degree of risk C) Portfolio weight D) Index value E) Price-earnings ratio 74) The expected rate of return on a stock portfolio is a weighted average where the weights are based on the: 74) A) original amount invested in each stock. B) market price per share of each stock. C) cost per share of each stock held. D) market value of the investment in each stock. E) number of shares owned of each stock 75) 75) The expected return on a portfolio considers which of the following factors? I. Percentage of the portfolio invested in each individual security II. Projected states of the economy III. The performance of each security given various economic states IV. Probability of occurrence for each state of the economy A) II and IV only B) I, III, and IV only C) I and III only D) II, III, and IV only E) I, II, III, and IV 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts