Question: #7-10 7) North Point, Inc, is considering Project A and Project B, which are two mutually exclusive projects with unequal lives. Project A is an

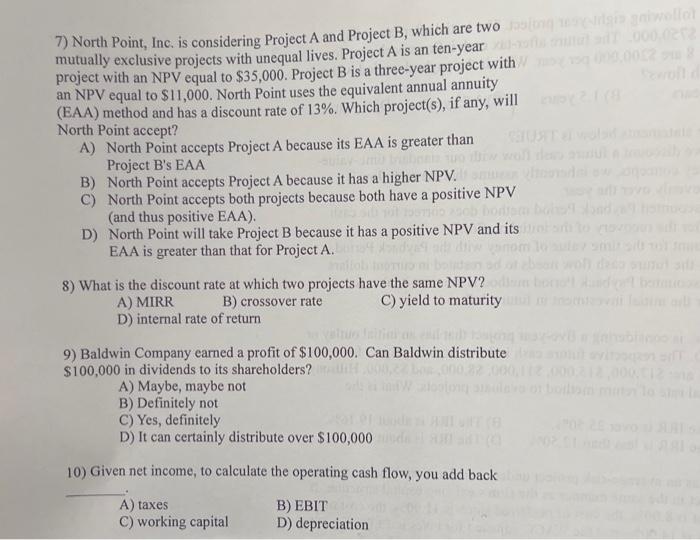

7) North Point, Inc, is considering Project A and Project B, which are two mutually exclusive projects with unequal lives. Project A is an ten-year project with an NPV equal to $35,000. Project B is a three-year project with an NPV equal to $11,000. North Point uses the equivalent annual annuity (EAA) method and has a discount rate of 13%. Which project(s), if any, will North Point accept? A) North Point accepts Project A because its EAA is greater than Project B's EAA B) North Point accepts Project A because it has a higher NPV. C) North Point accepts both projects because both have a positive NPV (and thus positive EAA). D) North Point will take Project B because it has a positive NPV and its EAA is greater than that for Project A. 8) What is the discount rate at which two projects have the same NPV? A) MIRR B) crossover rate C) yield to maturity D) internal rate of return 9) Baldwin Company earned a profit of $100,000. Can Baldwin distribute $100,000 in dividends to its shareholders? A) Maybe, maybe not B) Definitely not C) Yes, definitely D) It can certainly distribute over $100,000 10) Given net income, to calculate the operating cash flow, you add back A) taxes B) EBIT C) working capital D) depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts