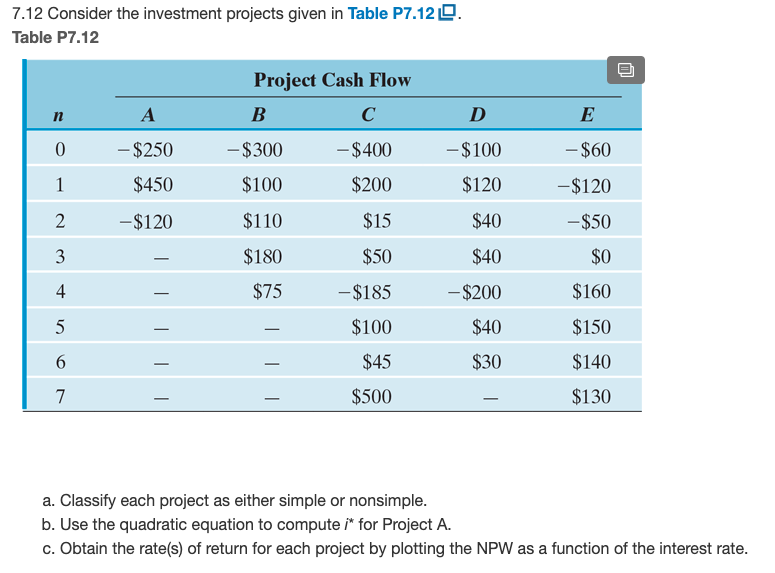

Question: . 7.12 Consider the investment projects given in Table P7.12 Table P7.12 n 0 1 A - $250 $450 -$120 - D -$100 $120 $40

. 7.12 Consider the investment projects given in Table P7.12 Table P7.12 n 0 1 A - $250 $450 -$120 - D -$100 $120 $40 Project Cash Flow B C $300 -$400 $100 $200 $110 $15 $180 $50 $75 -$185 - $100 - $45 - $500 E -$60 -$120 $50 $0 $160 $150 140 -$200 $40 $30 - $140 $130 7 - a. Classify each project as either simple or nonsimple. b. Use the quadratic equation to compute i* for Project A. c. Obtain the rate(s) of return for each project by plotting the NPW as a function of the interest rate. . 7.12 Consider the investment projects given in Table P7.12 Table P7.12 n 0 1 A - $250 $450 -$120 - D -$100 $120 $40 Project Cash Flow B C $300 -$400 $100 $200 $110 $15 $180 $50 $75 -$185 - $100 - $45 - $500 E -$60 -$120 $50 $0 $160 $150 140 -$200 $40 $30 - $140 $130 7 - a. Classify each project as either simple or nonsimple. b. Use the quadratic equation to compute i* for Project A. c. Obtain the rate(s) of return for each project by plotting the NPW as a function of the interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts