Question: 7.(20 pts) Please write the solution for this problem on paper You expect that the stock price will go significantly down from the strike prices

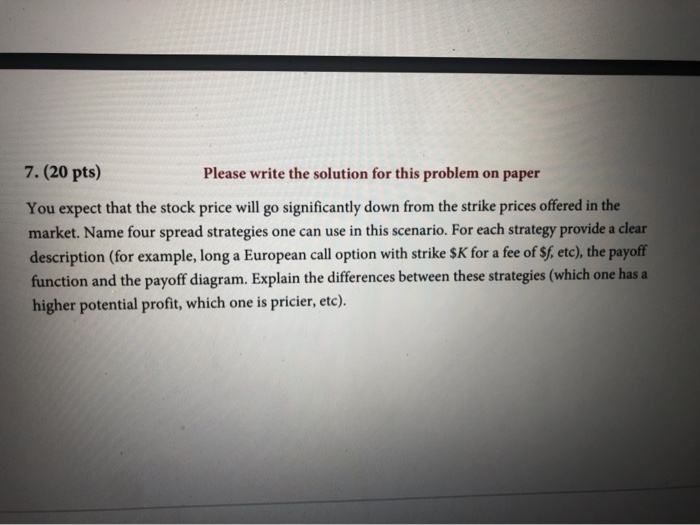

7.(20 pts) Please write the solution for this problem on paper You expect that the stock price will go significantly down from the strike prices offered in the market. Name four spread strategies one can use in this scenario. For each strategy provide a clear description (for example, long a European call option with strike $K for a fee of $f, etc), the payoff function and the payoff diagram. Explain the differences between these strategies (which one has a higher potential profit, which one is pricier, etc)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts