Question: 72-74 An audit client has refused to allow the auditors to perform a presumptively mandatory auditing procedure and there are no other effective alternate procedures

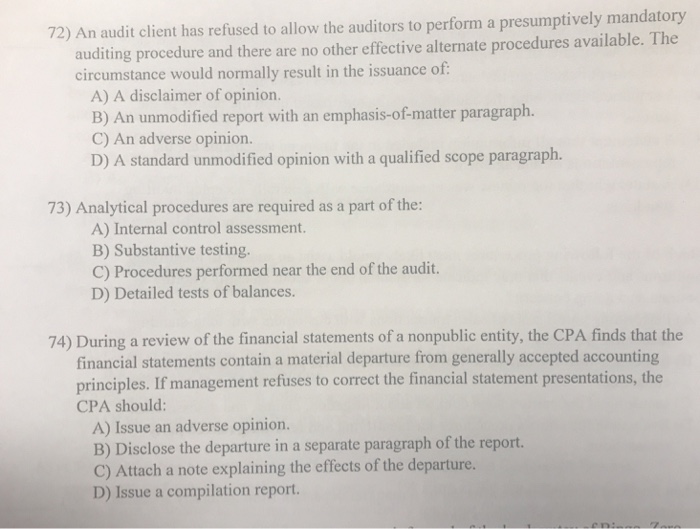

An audit client has refused to allow the auditors to perform a presumptively mandatory auditing procedure and there are no other effective alternate procedures available. The circumstance would normally result in the issuance of: A) A disclaimer of opinion. B) An unmodified report with an emphasis-of-matter paragraph. C) An adverse opinion. D) A standard unmodified opinion with a qualified scope paragraph. Analytical procedures are required as a part of the: A) Internal control assessment. B) Substantive testing. C) Procedures performed near the end of the audit. D) Detailed tests of balances. During a review of the financial statements of a nonpublic entity, the CPA finds that the financial statements contain a material departure from generally accepted accounting principles. If management refuses to correct the financial statement presentations, the CPA should: A) Issue an adverse opinion. B) Disclose the departure in a separate paragraph of the report. C) Attach a note explaining the effects of the departure. D) Issue a compilation report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts