Question: 73% Question 11 (3 + 3 +5+2= 13 marks) Black Inc (BI) has recently announced its intention to acquire White Ino. (WI). Information about the

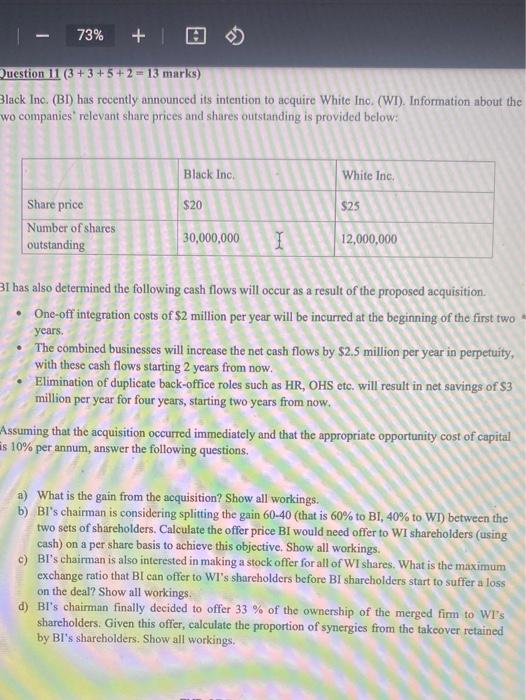

73% Question 11 (3 + 3 +5+2= 13 marks) Black Inc (BI) has recently announced its intention to acquire White Ino. (WI). Information about the wo companies" relevant share prices and shares outstanding is provided below: Black Inc White Ine, $20 $25 Share price Number of shares outstanding 30,000,000 I 12,000,000 31 has also determined the following cash flows will occur as a result of the proposed acquisition. One-off'integration costs of $2 million per year will be incurred at the beginning of the first two years The combined businesses will increase the net cash flows by $2.5 million per year in perpetuity, with these cash flows starting 2 years from now. Elimination of duplicate back-office roles such as HR, OHS etc. will result in net savings of $3 million per year for four years, starting two years from now. Assuming that the acquisition occurred immediately and that the appropriate opportunity cost of capital is 10% per annum, answer the following questions. a) What is the gain from the acquisition? Show all workings. b) BI's chairman is considering splitting the gain 60-40 (that is 60% to BI, 40% to WI) between the two sets of shareholders. Calculate the offer price BI would need offer to WI shareholders (using cash) on a per share basis to achieve this objective. Show all workings c) BI's chairman is also interested in making a stock offer for all of WI shares. What is the maximum exchange ratio that I can offer to WI's shareholders before BI shareholders start to suffer a loss on the deal? Show all workings. d) BI's chairman finally decided to offer 33 % of the ownership of the merged firm to Wr's shareholders. Given this offer, calculate the proportion of synergies from the takeover retained by BI's shareholders. Show all workings. 73% Question 11 (3 + 3 +5+2= 13 marks) Black Inc (BI) has recently announced its intention to acquire White Ino. (WI). Information about the wo companies" relevant share prices and shares outstanding is provided below: Black Inc White Ine, $20 $25 Share price Number of shares outstanding 30,000,000 I 12,000,000 31 has also determined the following cash flows will occur as a result of the proposed acquisition. One-off'integration costs of $2 million per year will be incurred at the beginning of the first two years The combined businesses will increase the net cash flows by $2.5 million per year in perpetuity, with these cash flows starting 2 years from now. Elimination of duplicate back-office roles such as HR, OHS etc. will result in net savings of $3 million per year for four years, starting two years from now. Assuming that the acquisition occurred immediately and that the appropriate opportunity cost of capital is 10% per annum, answer the following questions. a) What is the gain from the acquisition? Show all workings. b) BI's chairman is considering splitting the gain 60-40 (that is 60% to BI, 40% to WI) between the two sets of shareholders. Calculate the offer price BI would need offer to WI shareholders (using cash) on a per share basis to achieve this objective. Show all workings c) BI's chairman is also interested in making a stock offer for all of WI shares. What is the maximum exchange ratio that I can offer to WI's shareholders before BI shareholders start to suffer a loss on the deal? Show all workings. d) BI's chairman finally decided to offer 33 % of the ownership of the merged firm to Wr's shareholders. Given this offer, calculate the proportion of synergies from the takeover retained by BI's shareholders. Show all workings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts