Question: 7:36 Third Example-HW Third Example: A Service Company started operations on January 1, 2011 and the following are the transactions occurred in its first year

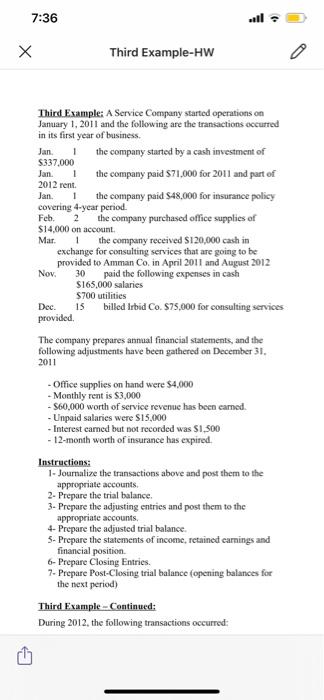

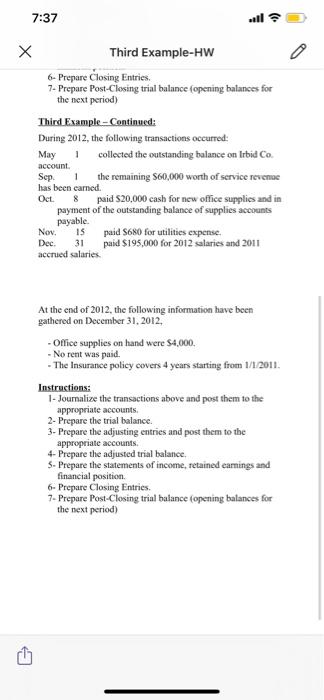

7:36 Third Example-HW Third Example: A Service Company started operations on January 1, 2011 and the following are the transactions occurred in its first year of business. Jan 1 the company started by a cash investment of 5337.000 Jan. 1 the company paid $71,000 for 2011 and part of 2012 rent Jan. 1 the company paid 548,000 for insurance policy covering 4-year period. Feb 2 the company purchased office supplies of $14,000 on account Mar. the company received S120,000 cash in exchange for consulting services that are going to be provided to Amman Co. in April 2011 and August 2012 Nov. 30 paid the following expenses in cash $165,000 salaries $700 utilities Dec. 15 billed Irbid Co. $75,000 for consulting services provided The company prepares annual financial statements, and the following adjustments have been gathered on December 31. 2011 1 - Office supplies on hand were $4.000 - Monthly rent is $3,000 - S60,000 worth of service revenue has been camed. -Unpaid salaries were $15,000 - Interest camned but not recorded was $1,500 - 12-month worth of insurance has expired. Instructions: 1- Journalize the transactions above and post them to the appropriate accounts 2. Prepare the trial balance. 3- Prepare the adjusting entries and post them to the appropriate accounts. 4- Prepare the adjusted trial balance 5- Prepare the statements of income, retained carnings and financial position 6- Prepare Closing Entries. 7- Prepare Post-Closing trial balance opening balances for the next period) Third Example - Continued: During 2012, the following transactions occurred: 7:37 al Third Example-HW 6- Prepare Closing Entries 7- Prepare Post-Closing trial balance fopening balances for the next period) Third Example - Continued: During 2012, the following transactions occurred: May collected the outstanding balance on Irbid Co. account Sep the remaining S60,000 worth of service revemae has been cared Oct. paid $20,000 cash for new office supplies and in payment of the outstanding balance of supplies accounts payable. 15 paid $680 for utilities expense Dec 31 paid $195,000 for 2012 salaries and 2011 accrued salaries. 8 Nov At the end of 2012, the following information have been gathered on December 31, 2012, Office supplies on hand were $4,000. - No rent was paid. - The Insurance policy covers 4 years starting from 1/1/2011, Instructions: 1- Journalize the transactions above and post them to the appropriate accounts 2- Prepare the trial balance. 3- Prepare the adjusting entries and post them to the appropriate accounts 4- Prepare the adjusted trial balance - Prepare the statements of income, retained earnings and financial position 6- Prepare Closing Entries. 7- Prepare Post-Closing trial balance opening balances for the next period) 7:36 Third Example-HW Third Example: A Service Company started operations on January 1, 2011 and the following are the transactions occurred in its first year of business. Jan 1 the company started by a cash investment of 5337.000 Jan. 1 the company paid $71,000 for 2011 and part of 2012 rent Jan. 1 the company paid 548,000 for insurance policy covering 4-year period. Feb 2 the company purchased office supplies of $14,000 on account Mar. the company received S120,000 cash in exchange for consulting services that are going to be provided to Amman Co. in April 2011 and August 2012 Nov. 30 paid the following expenses in cash $165,000 salaries $700 utilities Dec. 15 billed Irbid Co. $75,000 for consulting services provided The company prepares annual financial statements, and the following adjustments have been gathered on December 31. 2011 1 - Office supplies on hand were $4.000 - Monthly rent is $3,000 - S60,000 worth of service revenue has been camed. -Unpaid salaries were $15,000 - Interest camned but not recorded was $1,500 - 12-month worth of insurance has expired. Instructions: 1- Journalize the transactions above and post them to the appropriate accounts 2. Prepare the trial balance. 3- Prepare the adjusting entries and post them to the appropriate accounts. 4- Prepare the adjusted trial balance 5- Prepare the statements of income, retained carnings and financial position 6- Prepare Closing Entries. 7- Prepare Post-Closing trial balance opening balances for the next period) Third Example - Continued: During 2012, the following transactions occurred: 7:37 al Third Example-HW 6- Prepare Closing Entries 7- Prepare Post-Closing trial balance fopening balances for the next period) Third Example - Continued: During 2012, the following transactions occurred: May collected the outstanding balance on Irbid Co. account Sep the remaining S60,000 worth of service revemae has been cared Oct. paid $20,000 cash for new office supplies and in payment of the outstanding balance of supplies accounts payable. 15 paid $680 for utilities expense Dec 31 paid $195,000 for 2012 salaries and 2011 accrued salaries. 8 Nov At the end of 2012, the following information have been gathered on December 31, 2012, Office supplies on hand were $4,000. - No rent was paid. - The Insurance policy covers 4 years starting from 1/1/2011, Instructions: 1- Journalize the transactions above and post them to the appropriate accounts 2- Prepare the trial balance. 3- Prepare the adjusting entries and post them to the appropriate accounts 4- Prepare the adjusted trial balance - Prepare the statements of income, retained earnings and financial position 6- Prepare Closing Entries. 7- Prepare Post-Closing trial balance opening balances for the next period)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts