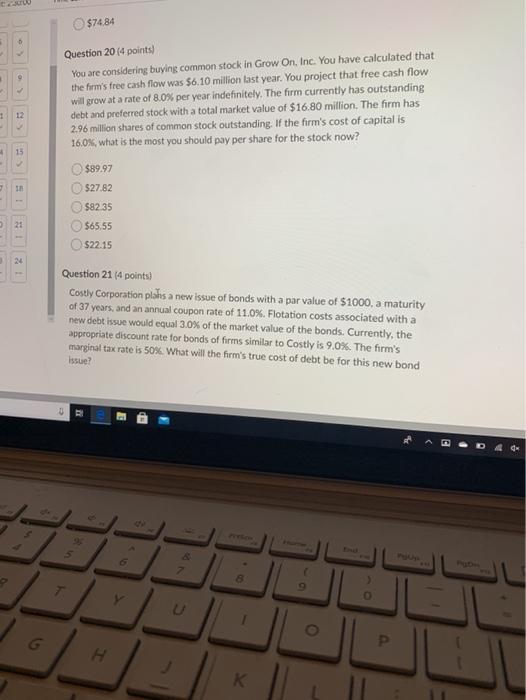

Question: $74 84 + Question 20 (4 points) You are considering buying common stock in Grow On, Inc. You have calculated that the firm's free cash

$74 84 + Question 20 (4 points) You are considering buying common stock in Grow On, Inc. You have calculated that the firm's free cash flow was $6.10 million last year. You project that free cash flow will grow at a rate of 8.0% per year indefinitely. The firm currently has outstanding debt and preferred stock with a total market value of $16.80 million. The firm has 2.96 million shares of common stock outstanding. If the firm's cost of capital is 16.0%, what is the most you should pay per share for the stock now? $89.97 $27.82 $82.35 $65.55 $22.15 2 Question 21 (4 points) Costly Corporation plshs a new issue of bonds with a par value of $1000, a maturity of 37 years, and an annual coupon rate of 11.0%. Flotation costs associated with a new debt issue would equal 3.0% of the market value of the bonds. Currently, the appropriate discount rate for bonds of firms similar to Costly is 9.0%. The firm's marginal tax rate is 50% What will the firm's true cost of debt be for this new bond Issue? 7 8. P H K

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts