Question: 7:4 two missing boxes help (Financial analysis) The T. P Jarmon Company manufactures and sells a line of exclusive sportswear. The firm's sales were $600,000

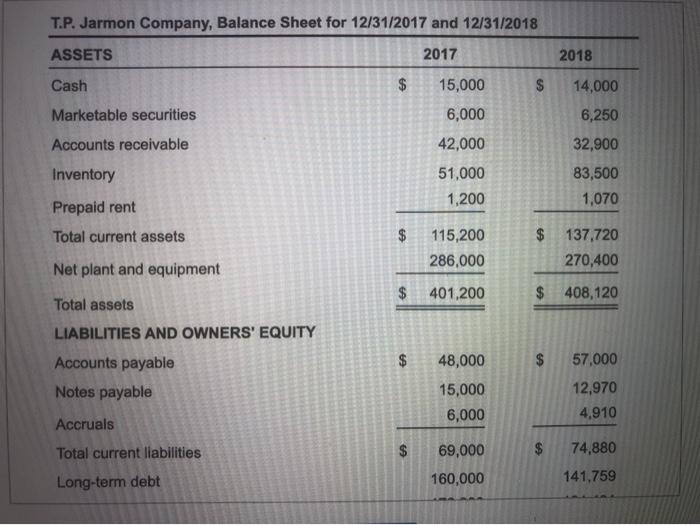

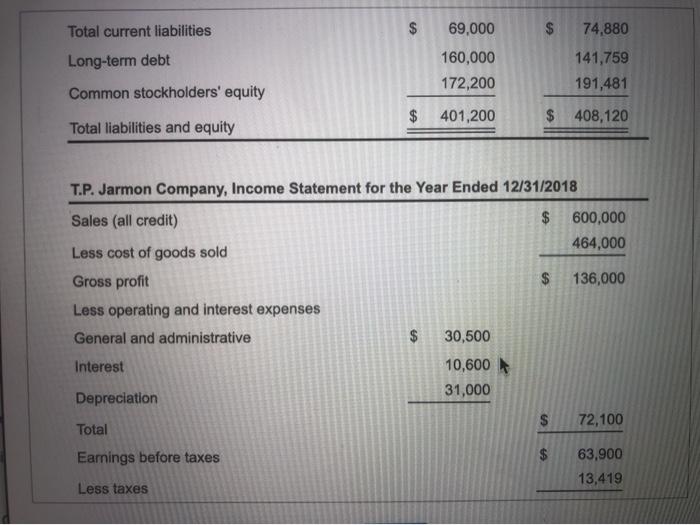

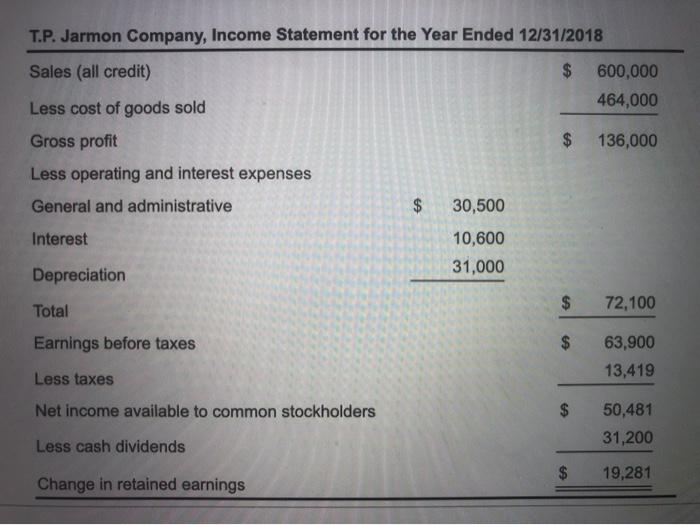

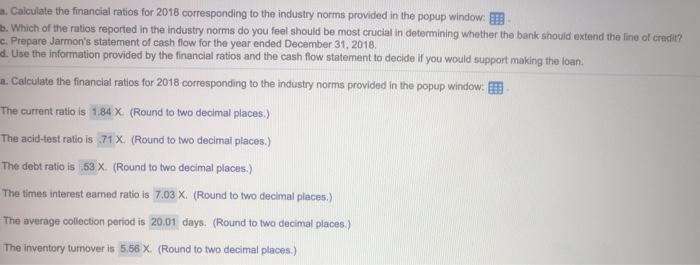

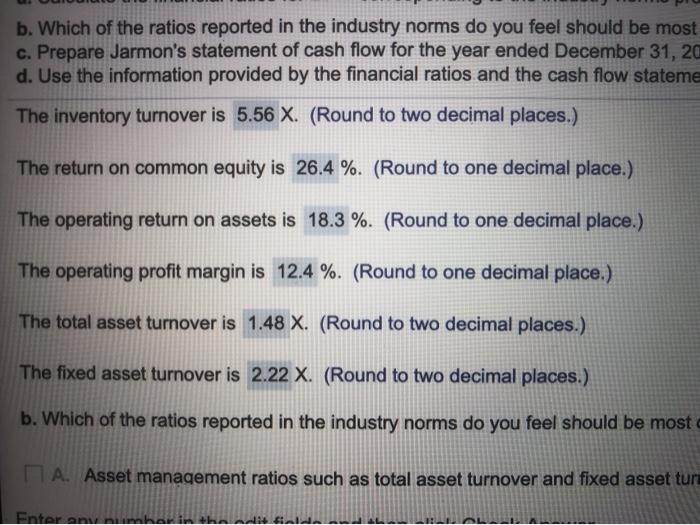

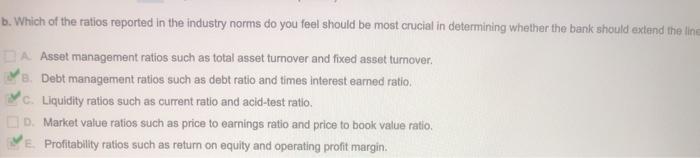

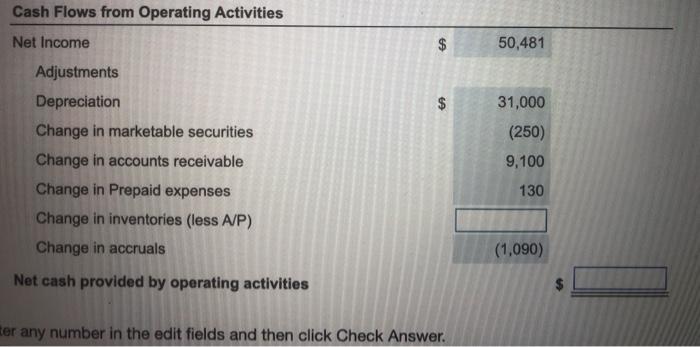

(Financial analysis) The T. P Jarmon Company manufactures and sells a line of exclusive sportswear. The firm's sales were $600,000 for the year just ended, and its total assets was $408,120. The company was started by Mr. Jarmon just 10 years ago and has been profitable every year since its inception. The chief financial officer for the firm, Brent Vehlim, has decided to seek a line of credit totaling $95,000 from the firm's bank. In the past, the company has relied on its suppliers to finance a large part of its needs for inventory. However, in recent months tight money conditions have led the firm's suppliers to offer sizable cash discounts to speed up payments for purchases. Mr. Vehlim wants to use the line of credit to replace a large portion of the firm's payables during the summer, which is the firm's peak seasonal sales period. The firm's two most recent balance sheets were presented to the bank in support of its loan request. In addkion, the firm's income statement for the year just ended was provided. These statements are found in the popup window. B. Mike Ameen, associate credit analyst for the Merchants National Bank of Midland, Michigan was assigned the task of analyzing Jarmon's loan request. T.P. Jarmon Company, Balance Sheet for 12/31/2017 and 12/31/2018 ASSETS 2017 2018 Cash $ 15,000 $ 14,000 Marketable securities 6,000 6,250 Accounts receivable Inventory Prepaid rent Total current assets 42,000 51,000 1,200 32,900 83,500 1,070 $ 115,200 286,000 $ 137,720 270,400 Net plant and equipment $ 401,200 $ 408,120 Total assets LIABILITIES AND OWNERS' EQUITY $ 48,000 Accounts payable Notes payable 15,000 6,000 57,000 12,970 4,910 Accruals Total current liabilities 69,000 $ 74,880 141,759 Long-term debt 160,000 Total current liabilities $ 69,000 $ Long-term debt 160,000 172,200 74,880 141,759 191,481 Common stockholders' equity $ $ 401,200 $ 408,120 Total liabilities and equity T.P. Jarmon Company, Income Statement for the Year Ended 12/31/2018 Sales (all credit) $ 600,000 464,000 $ 136,000 Less cost of goods sold Gross profit Less operating and interest expenses General and administrative Interest 30,500 10,600 31,000 Depreciation 72,100 Total $ $ Earnings before taxes 63,900 13,419 Less taxes T.P. Jarmon Company, Income Statement for the Year Ended 12/31/2018 Sales (all credit) $ 600,000 464,000 Less cost of goods sold Gross profit 136,000 Less operating and interest expenses General and administrative $ 30,500 Interest 10,600 31,000 Depreciation $ Total 72,100 Earnings before taxes 63,900 13,419 Less taxes Net income available to common stockholders 50,481 31,200 Less cash dividends 19,281 Change in retained earnings $ b. Which of the ratios reported in the industry norms do you feel should be most c. Prepare Jarmon's statement of cash flow for the year ended December 31, 20 d. Use the information provided by the financial ratios and the cash flow stateme The inventory turnover is 5.56 X. (Round to two decimal places.) The return on common equity is 26.4 %. (Round to one decimal place.) The operating return on assets is 18.3 %. (Round to one decimal place.) The operating profit margin is 12.4 %. (Round to one decimal place.) The total asset turnover is 1.48 X. (Round to two decimal places.) The fixed asset turnover is 2.22 X. (Round to two decimal places.) b. Which of the ratios reported in the industry norms do you feel should be most I A. Asset management ratios such as total asset turnover and fixed asset tur Enter any number in this field b. Which of the ratios reported in the industry norms do you feel should be most crucial in determining whether the bank should extend the line DA Asset management ratios such as total asset turnover and fixed asset turnover. ra. Debt management ratios such as debt ratio and times interest eamed ratio, c. Liquidity ratios such as current ratio and acid-test ratio D. Market value ratios such as price to earnings ratio and price to book value ratio. Profitability ratios such as retum on equity and operating profit margin. Cash Flows from Operating Activities Net Income $ 50,481 $ $ 31,000 (250) 9,100 Adjustments Depreciation Change in marketable securities Change in accounts receivable Change in Prepaid expenses Change in inventories (less A/P) Change in accruals Net cash provided by operating activities 130 (1,090) ter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts