Question: 75 In this problem we consider whether parity is violated by any of the option prices in the following table of IBM option prices, dollars

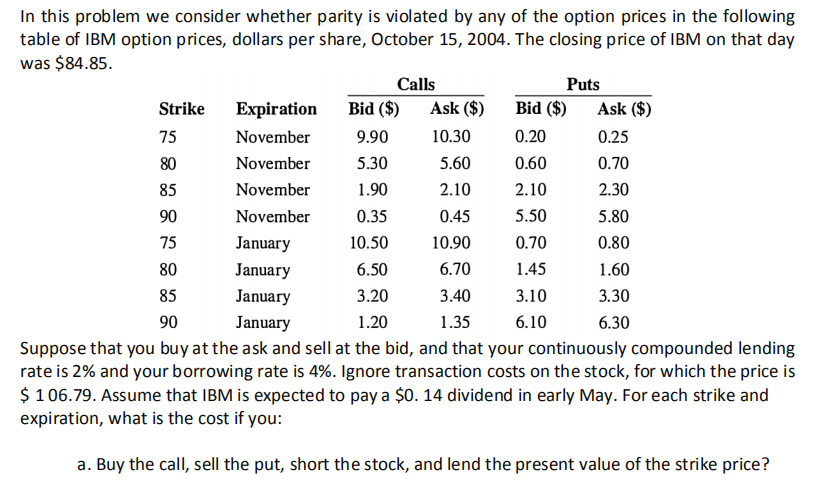

75 In this problem we consider whether parity is violated by any of the option prices in the following table of IBM option prices, dollars per share, October 15, 2004. The closing price of IBM on that day was $84.85. Calls Puts Strike Expiration Bid ($) Ask ($) Bid ($) Ask ($) November 9.90 10.30 0.20 0.25 80 November 5.30 5.60 0.60 0.70 85 November 1.90 2.10 2.10 2.30 90 November 0.35 0.45 5.50 5.80 75 January 10.50 10.90 0.70 0.80 January 6.50 6.70 1.45 1.60 85 January 3.20 3.40 3.10 3.30 90 January 1.20 1.35 6.10 6.30 Suppose that you buy at the ask and sell at the bid, and that your continuously compounded lending rate is 2% and your borrowing rate is 4%. Ignore transaction costs on the stock, for which the price is $ 106.79. Assume that IBM is expected to pay a $0. 14 dividend in early May. For each strike and expiration, what is the cost if you: 80 a. Buy the call, sell the put, short the stock, and lend the present value of the strike price? 75 In this problem we consider whether parity is violated by any of the option prices in the following table of IBM option prices, dollars per share, October 15, 2004. The closing price of IBM on that day was $84.85. Calls Puts Strike Expiration Bid ($) Ask ($) Bid ($) Ask ($) November 9.90 10.30 0.20 0.25 80 November 5.30 5.60 0.60 0.70 85 November 1.90 2.10 2.10 2.30 90 November 0.35 0.45 5.50 5.80 75 January 10.50 10.90 0.70 0.80 January 6.50 6.70 1.45 1.60 85 January 3.20 3.40 3.10 3.30 90 January 1.20 1.35 6.10 6.30 Suppose that you buy at the ask and sell at the bid, and that your continuously compounded lending rate is 2% and your borrowing rate is 4%. Ignore transaction costs on the stock, for which the price is $ 106.79. Assume that IBM is expected to pay a $0. 14 dividend in early May. For each strike and expiration, what is the cost if you: 80 a. Buy the call, sell the put, short the stock, and lend the present value of the strike price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts