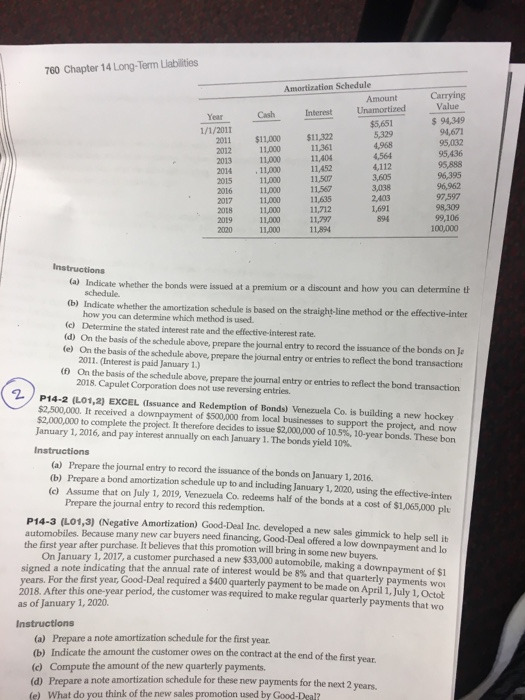

Question: 760 Chapter 14 Long-Term Liabilities Amortization Schedule Carrying Amount Year Cash Interest Unamortized Value $94,349 $5,651 5,329 11,000 $11,322 2011 2012 2013 2014 95,032 95,436

760 Chapter 14 Long-Term Liabilities Amortization Schedule Carrying Amount Year Cash Interest Unamortized Value $94,349 $5,651 5,329 11,000 $11,322 2011 2012 2013 2014 95,032 95,436 95,888 96,395 96,962 97,597 11,000 4,564 4,112 11,000 11,000 11,000 11,000 11,000 11,000 11,000 11,452 11,507 11,567 11,635 11,712 11,797 11,894 3,038 2018 2019 99,106 100,000 894 (a) Indicate whether the bonds were issued at a premium or a discount and how you can determine th schedule. (b) Indicate whether the amortization schedule is based on the straight-line method or the how you can determine which method is used. effective-inter (c) Determine the stated interest rate and the effective-interest rate. (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on Je (e) On the basis of the schedule above, prepare the journal entry or entries to reflect the bond transactions (0) 2011. (Interest is paid January 1.) On the basis of the schedule above, prepare the jounal entry or entries to reflect the bond transaction 2018. Capulet Corporation does not use reversing entries 2 P14-2 (L01,2) EXCEL (Issuance and Redemption of Bonds) Venezuela Co. is building a new hockey $2,500,000. It received a downpayment of $500,000 from local businesses to support the project, and now $2.000,000 to complete the p yect. It there fore decides to issue S2 000 000 of 10.5%, 10-year bonds. These bon January 1, 2016, and pay interest annually on each January 1. The bonds yield 10% Instructions Prepare the journal entry to record the issuance of the bonds on January 1, 2016. (b) Prepare a bond amortization schedule up to and including January 1, 2020, using the effective-inter () Assume that on July 1, 2019, Venezuela Co. redeems half of the bonds at a cost of $1,065,000 plu (a) Prepare the journal entry to record this redemption. P14-3 (L01,3) (Negative Amortization) Good-Deal Inc. developed a new sales gimmick to help sell it automobiles. Because many new car buyers need financing. Good-Deal offered a low downpayment and lo On lanuary 1, 2017, a customer purchased a new $33,000 automobile, making a downpayment of $1 that the annual rate of interest would be 8% and that quarterly payments wou the first year after purchase. It believes that this promotion will bring in some new buyers. signed a note indicating 2018. After this one-yea as of January 1, 2020 Instructions For the first year, Good-Deal required a $400 quarterly payment to be made on April i, July 1, Octot r period, the customer was required to make regular quarterly payments that wo (a) Prepare a note amortization schedule for the first year (b) Indicate the amount the customer owes on the contract at the end of the first (e) Compute the amount of the new quarterly payments. (d) Prepare a note amortization schedule for these new payments for the next 2 (e) What do you think of the new sales promotion used by Good-Dgal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts