Question: 77 Brief Exercise 7-12 (Algo) Record depreciation using activity-based method (LO7-4) On January 1, Hawaiian Specialty Foods purchased equipment for $39,000. Residual value at the

77

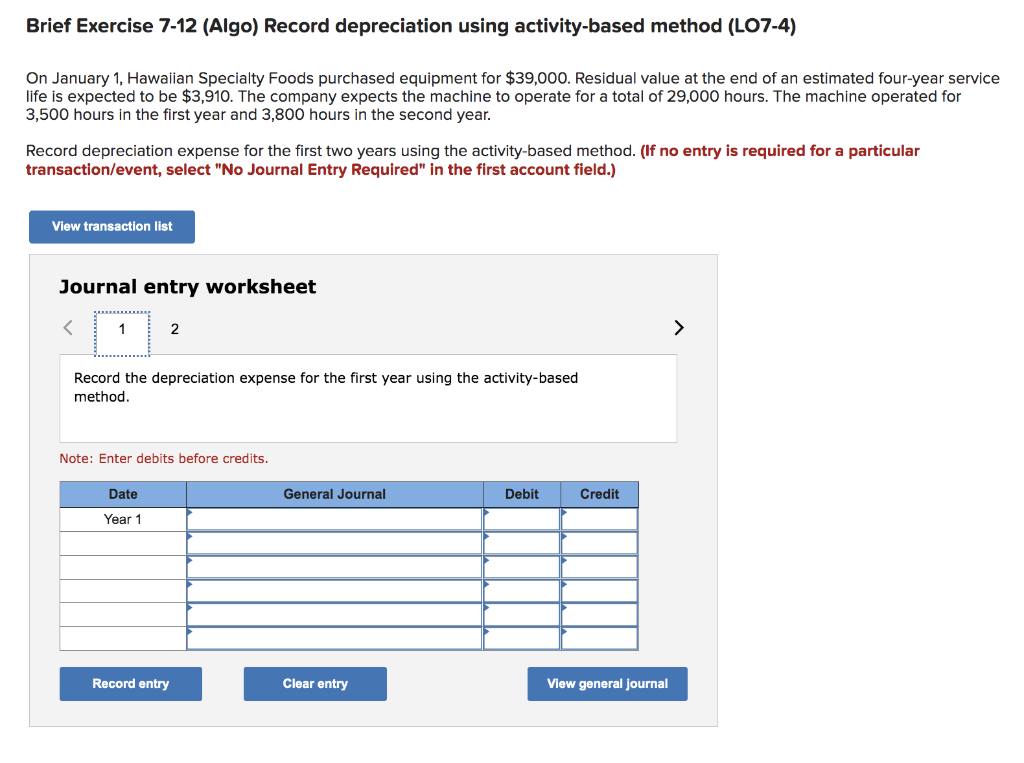

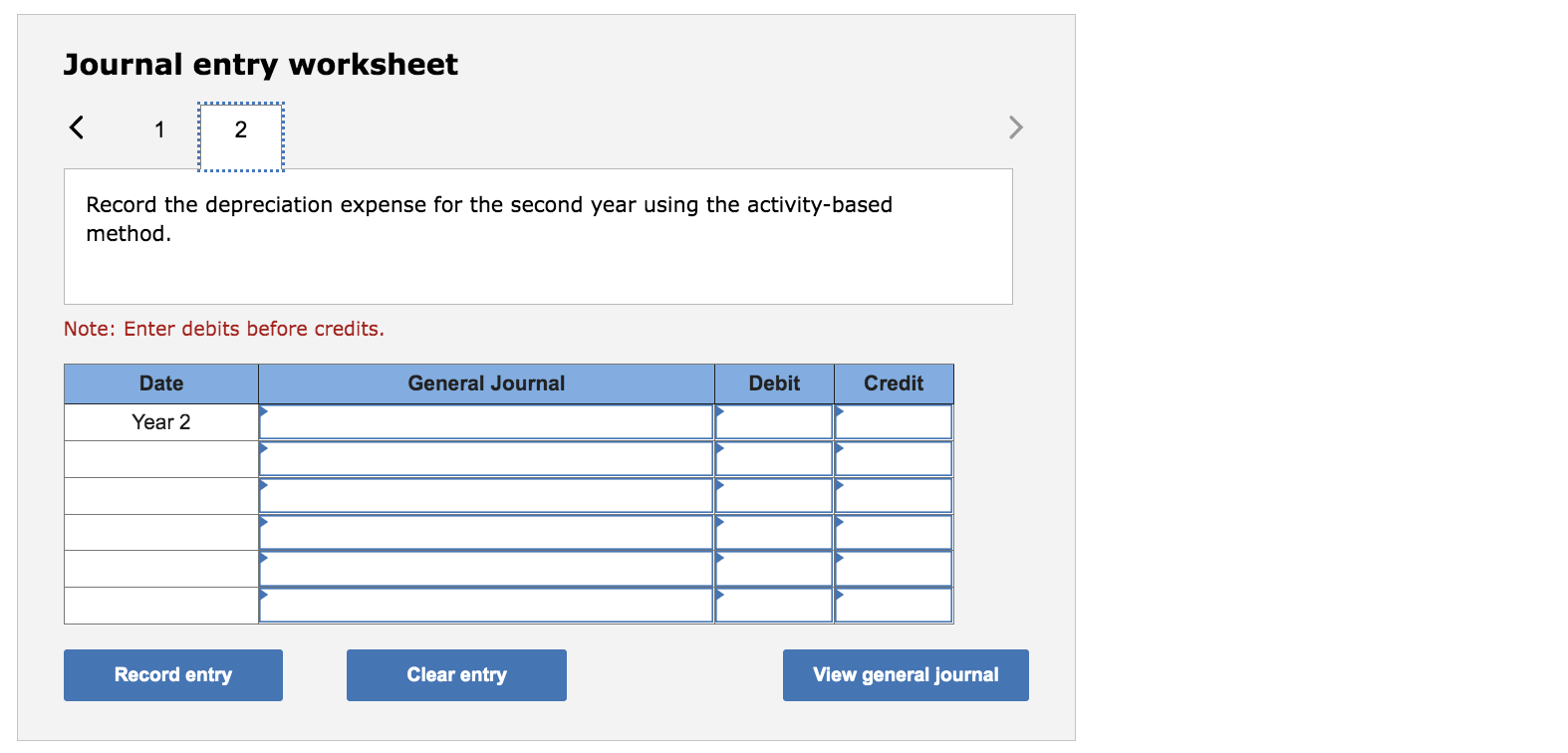

Brief Exercise 7-12 (Algo) Record depreciation using activity-based method (LO7-4) On January 1, Hawaiian Specialty Foods purchased equipment for $39,000. Residual value at the end of an estimated four-year service life is expected to be $3,910. The company expects the machine to operate for a total of 29,000 hours. The machine operated for 3,500 hours in the first year and 3,800 hours in the second year. Record depreciation expense for the first two years using the activity-based method. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the depreciation expense for the first year using the activity-based method. Note: Enter debits before credits. Journal entry worksheet Record the depreciation expense for the second year using the activity-based method. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts