Question: 789 NEED JUST PERFECT ANSWERS NO SOLUTION NEEDED. ( ) 7. You sold one corn future contract at $2.29 per bushel. What would be your

789 NEED JUST PERFECT ANSWERS NO SOLUTION NEEDED.

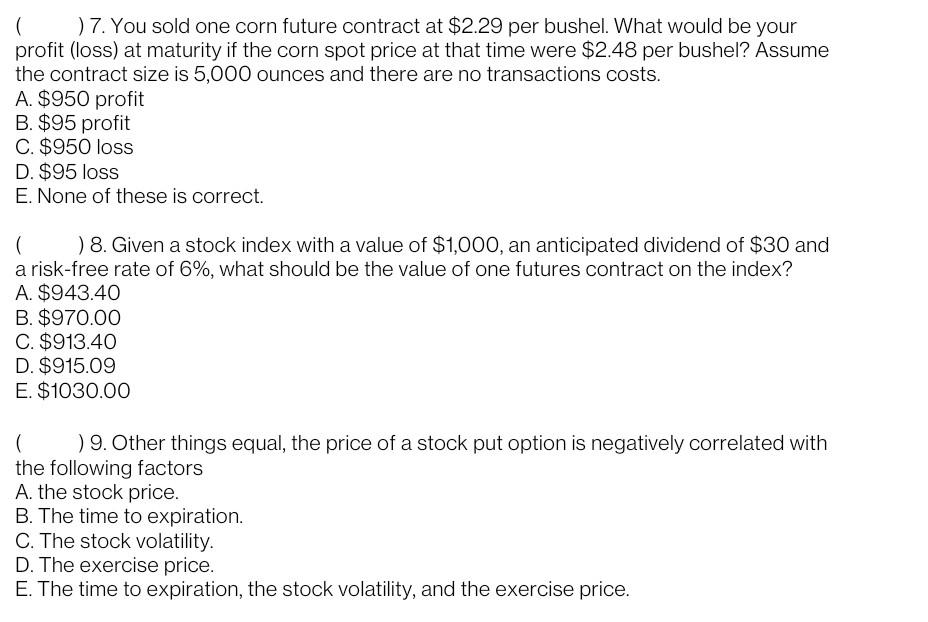

( ) 7. You sold one corn future contract at $2.29 per bushel. What would be your profit (loss) at maturity if the corn spot price at that time were $2.48 per bushel? Assume the contract size is 5,000 ounces and there are no transactions costs. A. $950 profit B. $95 profit C. $950 loss D. $95 loss E. None of these is correct. ( ) 8. Given a stock index with a value of $1,000, an anticipated dividend of $30 and a risk-free rate of 6%, what should be the value of one futures contract on the index? A. $943.40 B. $970.00 C. $913.40 D. $915.09 E. $1030.00 ( ) 9. Other things equal, the price of a stock put option is negatively correlated with the following factors A. the stock price. B. The time to expiration. C. The stock volatility. D. The exercise price. E. The time to expiration, the stock volatility, and the exercise price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts