Question: 7a-2 updated with correct info 7A-2. Compute the net pay for each employee using the federal income tax withholding table in Figure 7.2. Assume that

7a-2 updated with correct info

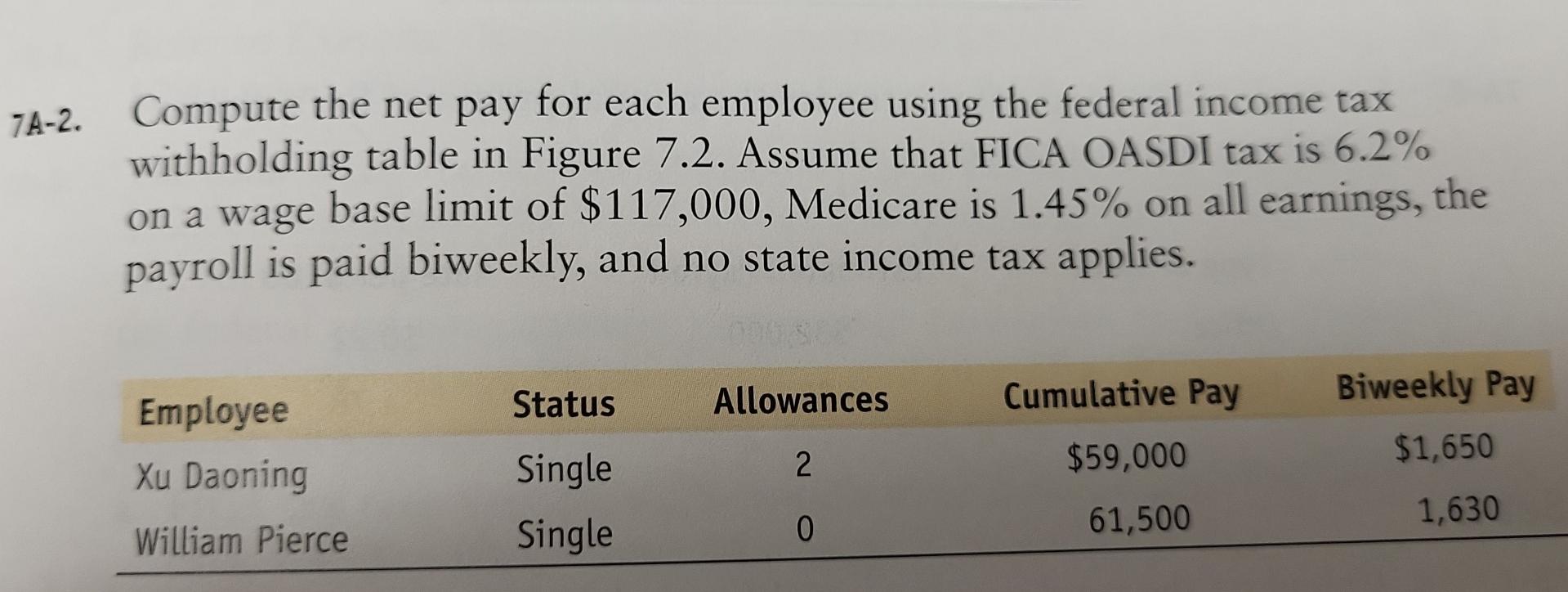

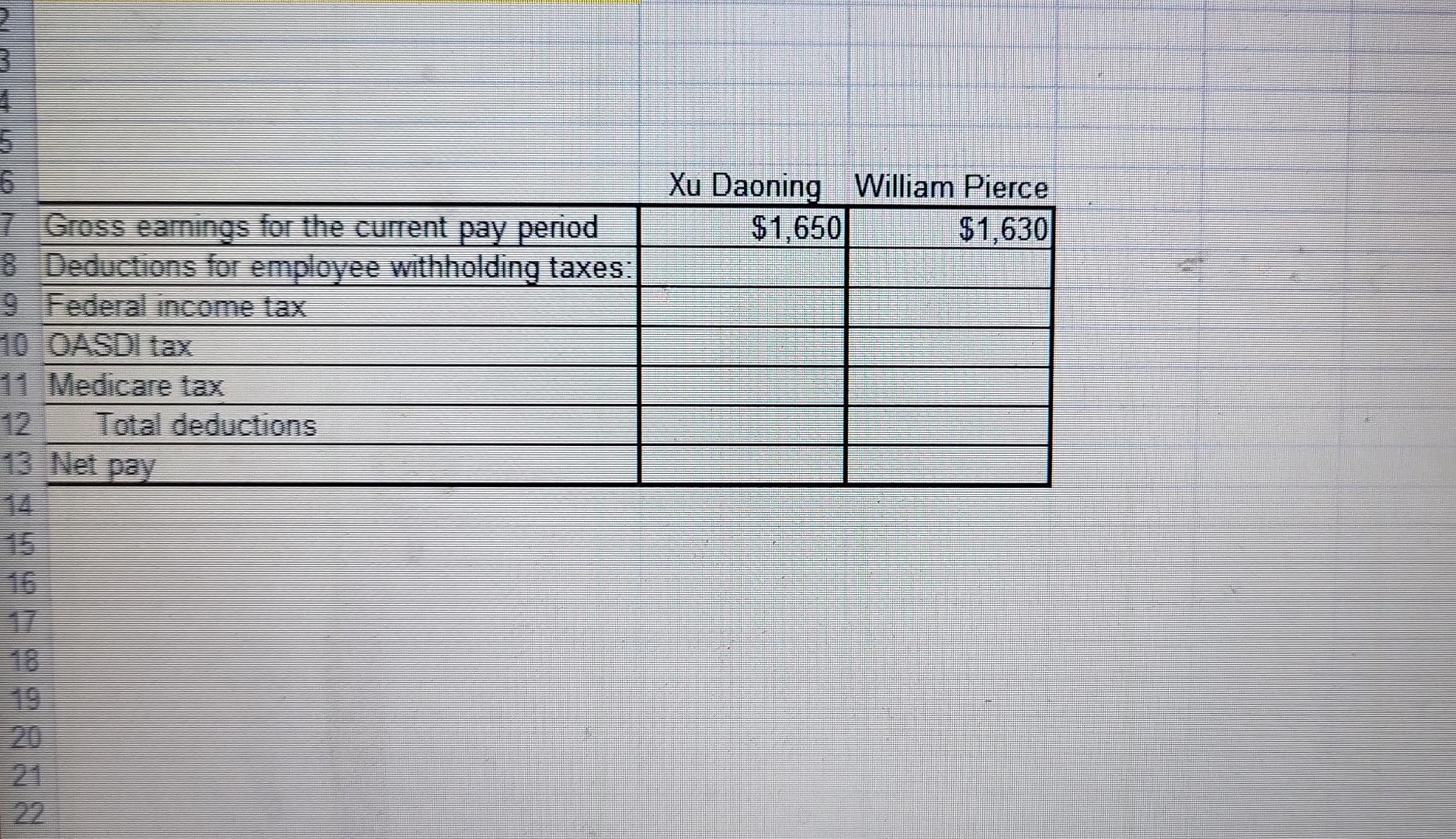

7A-2. Compute the net pay for each employee using the federal income tax withholding table in Figure 7.2. Assume that FICA OASDI tax is 6.2% on a wage base limit of $117,000, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. Status Employee Allowances Biweekly Pay Cumulative Pay Xu Daoning $1,650 2 Single $59,000 William Pierce 1,630 Single 0 61,500 7A-2. Compute the net pay for each employee using the federal income tax withholding table in Figure 7.2. Assume that FICA OASDI tax is 6.2% on a wage base limit of $117,000, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. Status Employee Allowances Biweekly Pay Cumulative Pay Xu Daoning $1,650 2 Single $59,000 William Pierce 1,630 Single 0 61,500 2 3 4 5 6 7 Gross earnings for the current pay period 8 Deductions for employee withholding taxes: 9 Federal income tax 10 OASDI tax 11 Medicare tax Total deductions 13 Net pay 16 17 10 19 Xu Daoning William Pierce $1,650 $1,630

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts