Question: 7.Lemons problems occur before parties enter into contracts. A question requiring a True/False' answer.(Required) True False 8.If there is no low-cost way to address the

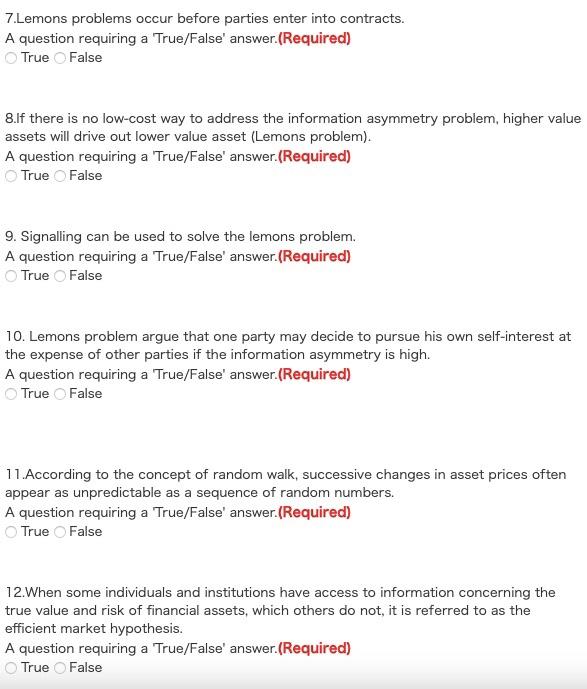

7.Lemons problems occur before parties enter into contracts. A question requiring a True/False' answer.(Required) True False 8.If there is no low-cost way to address the information asymmetry problem, higher value assets will drive out lower value asset (Lemons problem). A question requiring a True/False' answer.(Required) True False 9. Signalling can be used to solve the lemons problem. A question requiring a True/False' answer.(Required) True False 10. Lemons problem argue that one party may decide to pursue his own self-interest at the expense of other parties if the information asymmetry is high. A question requiring a True/False' answer.(Required) True False 11.According to the concept of random walk, successive changes in asset prices often appear as unpredictable as a sequence of random numbers. A question requiring a True/False' answer. (Required) True False 12.When some individuals and institutions have access to information concerning the true value and risk of financial assets, which others do not, it is referred to as the efficient market hypothesis. A question requiring a True/False' answer.(Required) True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts