Question: 8 . 0 7 PM Sun May 1 8 Done kaplanlearn.com I FP 5 1 5 OnDemand Retirement Savings and Income Planming Question 2 1

PM Sun May

Done

kaplanlearn.com

I

FP OnDemand Retirement Savings and Income Planming

Question of

Question ID:

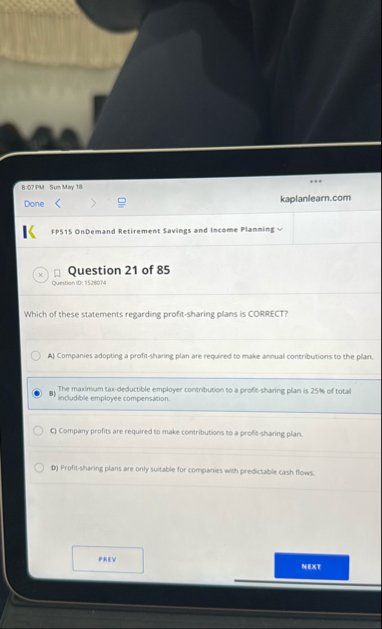

Which of these statements regarding profitsharing plans is CORRECT?

A Companies adopting a profinsharing plan are required to make annual contributions to the plan.

B The maximum taxdeductible employer contribution to a profisharing plan is of total indudible employee compensation.

C Company profits are required to make contributions to a profitsharing plan.

D Profitsharing plans are only suitable for companies with predictable cash flows.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock