Question: 8% 0.4 Question 4 (25 marks / Risk & Return and Equity Valuation) (a) Donald is considering the merits of two securities. He is interested

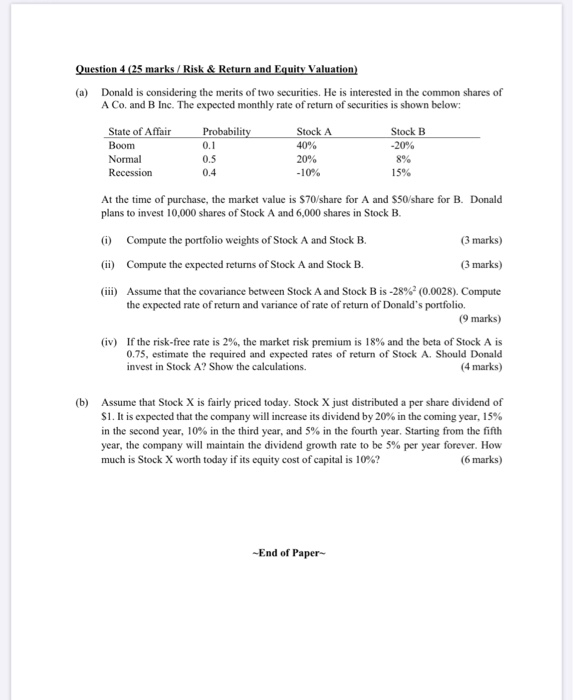

8% 0.4 Question 4 (25 marks / Risk & Return and Equity Valuation) (a) Donald is considering the merits of two securities. He is interested in the common shares of A Co. and B Inc. The expected monthly rate of return of securities is shown below: State of Affair Probability Stock A Stock B Boom 0.1 40% -20% Normal 0.5 20% Recession -10% 15% At the time of purchase, the market value is $70/share for A and $50/share for B. Donald plans to invest 10,000 shares of Stock A and 6,000 shares in Stock B. (1) Compute the portfolio weights of Stock A and Stock B. (3 marks) (11) Compute the expected returns of Stock A and Stock B. (3 marks) (iii) Assume that the covariance between Stock A and Stock B is -28% (0.0028). Compute the expected rate of return and variance of rate of return of Donald's portfolio. (9 marks) (iv) If the risk-free rate is 2%, the market risk premium is 18% and the beta of Stock A is 0.75, estimate the required and expected rates of return of Stock A. Should Donald invest in Stock A? Show the calculations. (4 marks) (b) Assume that Stock X is fairly priced today. Stock X just distributed a per share dividend of $1. It is expected that the company will increase its dividend by 20% in the coming year, 15% in the second year, 10% in the third year, and 5% in the fourth year. Starting from the fifth year, the company will maintain the dividend growth rate to be 5% per year forever. How much is Stock X worth today if its equity cost of capital is 10%? (6 marks) -End of Paper

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts