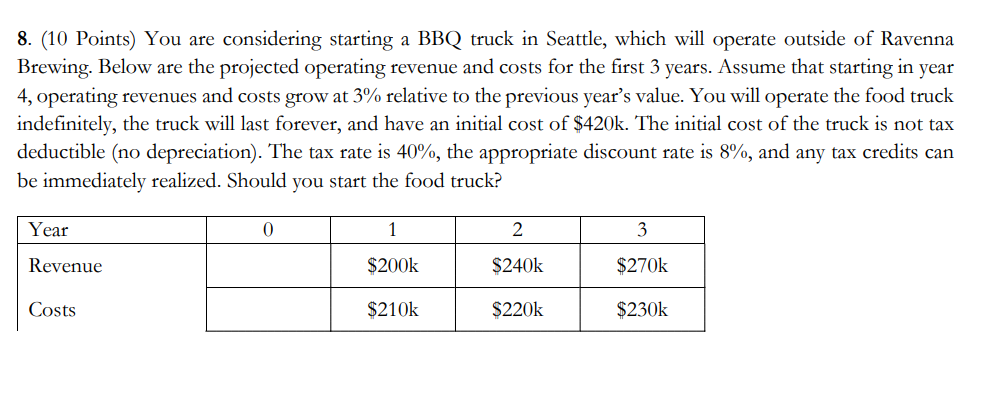

Question: 8 . ( 1 0 Points ) You are considering starting a BBQ truck in Seattle, which will operate outside of Ravenna Brewing. Below are

Points You are considering starting a BBQ truck in Seattle, which will operate outside of Ravenna Brewing. Below are the projected operating revenue and costs for the first years. Assume that starting in year operating revenues and costs grow at relative to the previous year's value. You will operate the food truck indefinitely, the truck will last forever, and have an initial cost of $ mathrmk The initial cost of the truck is not tax deductible no depreciation The tax rate is the appropriate discount rate is and any tax credits can be immediately realized. Should you start the food truck?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock