Question: 8 1 3 ? 2 5 , 1 : 2 3 P M Training detail: Curriculum Test - Tax Knowledge Assessment ( 2 0 2

:

Training detail: Curriculum

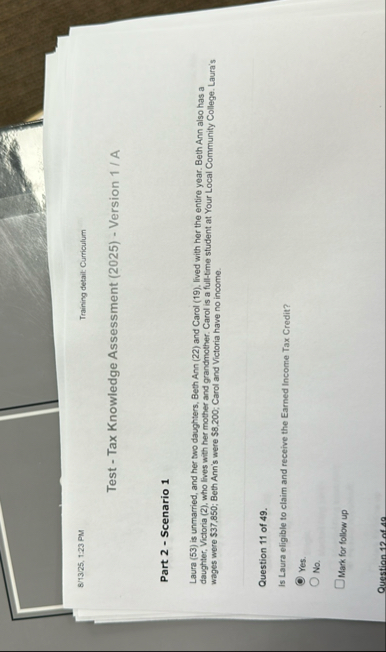

Test Tax Knowledge Assessment Version A

Part Scenario

Laura is unmarried, and her two daughters, Beth Ann and Carol lived with her the entire year. Beth Ann also has a daughter, Victoria who lives with her mother and grandmother. Carol is a fulltime student at Your Local Community College. Laura's wages were $; Beth Ann's were $; Carol and Victoria have no income.

Question of

Is Laura eligible to claim and receive the Earned Income Tax Credit?

Yes.

No

Mark for follow up

Question of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock