Question: 8 . 1 8 PM SunMay 1 8 Done kaplanlearn.com I FPS 1 5 OnDemand Retirement Savings and Income Planning ~ Question 3 1 of

PM SunMay

Done

kaplanlearn.com

I

FPS OnDemand Retirement Savings and Income Planning ~

Question of

Question

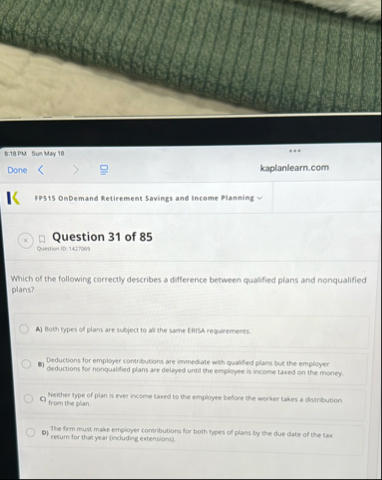

Which of the following correctly describes a difference between qualified plans and nonqualified plans?

A Both types of plans are subject to all the same TRISA requerements.

B Deductions for employer contributions are immed ate with qualified pluns but the employer deductions for nonqualified plans are delayed until the enployee is income laxed on the money.

C Ne cher type of plan is ever income taxed to the employee before the worker lakes a distribution frem the plan.

D The form must make employer contributions for borh lypers of plans by the due clate of the cus return for that year including extensions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock