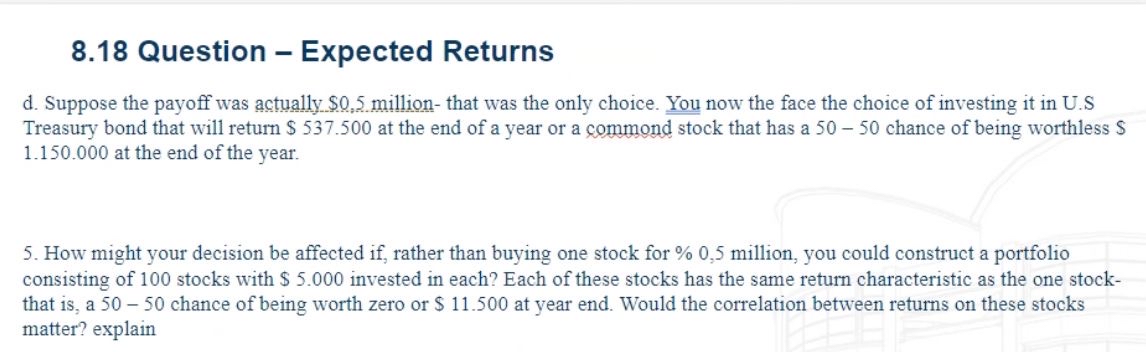

Question: 8 . 1 8 Question - Expected Returns d . Suppose the payoff was actually $ 0 , 5 million - that was the only

Question Expected Returns

d Suppose the payoff was actually $ million that was the only choice. You now the face the choice of investing it in US

Treasury bond that will return $ at the end of a year or a commond stock that has a chance of being worthless $

at the end of the year.

How might your decision be affected if rather than buying one stock for million, you could construct a portfolio

consisting of stocks with $ invested in each? Each of these stocks has the same return characteristic as the one stock

that is a chance of being worth zero or $ at year end. Would the correlation between returns on these stocks

matter? explain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock