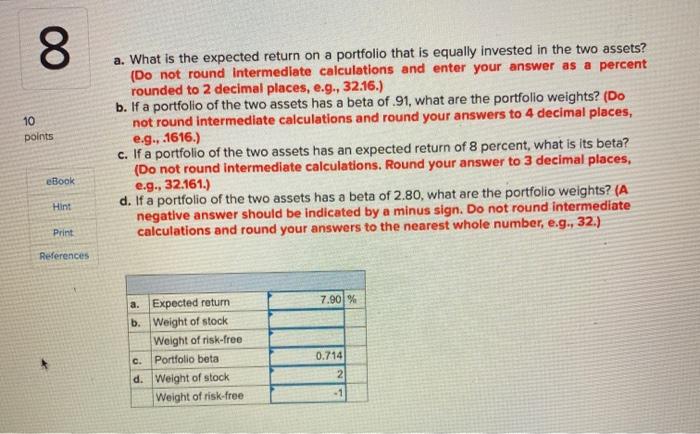

Question: 8 10 points a. What is the expected return on a portfolio that is equally invested in the two assets? (Do not round Intermediate calculations

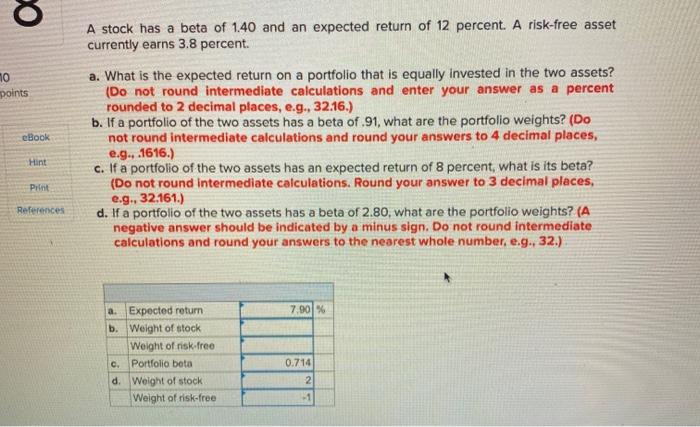

8 10 points a. What is the expected return on a portfolio that is equally invested in the two assets? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If a portfolio of the two assets has a beta of.91, what are the portfolio weights? (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., 1616.) c. If a portfolio of the two assets has an expected return of 8 percent, what is its beta? (Do not round intermediate calculations. Round your answer to 3 decimal places, e.g., 32.161.) d. If a portfolio of the two assets has a beta of 2.80, what are the portfolio weights? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) eBook Hint Print References 7.90% a. Expected return b. Weight of stock Weight of risk-free c. Portfolio beta d. Weight of stock Weight of risk-free 0.714 2 - 1 8 A stock has a beta of 1.40 and an expected return of 12 percent. A risk-free asset currently earns 3.8 percent. mo points eBook Hint a. What is the expected return on a portfolio that is equally invested in the two assets? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 3216.) b. If a portfolio of the two assets has a beta of .91, what are the portfolio weights? (Do not round intermediate calculations and round your answers to 4 decimal places, e.g., 1616.) c. If a portfolio of the two assets has an expected return of 8 percent, what is its beta? (Do not round Intermediate calculations. Round your answer to 3 decimal places, e.g., 32.161.) d. If a portfolio of the two assets has a beta of 2.80, what are the portfolio weights? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) Print References 7.90% a. Expected return b. Weight of stock Weight of risk.free c. Portfolio bota d. Weight of stock Weight of risk-free 0.714 2 -1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts