Question: 8. -11 points BBUnderStat12 5.1.017. My Notes Ask Your Teacher Jim is a 60-year-old Anglo male in reasonably good health. He wants to take out

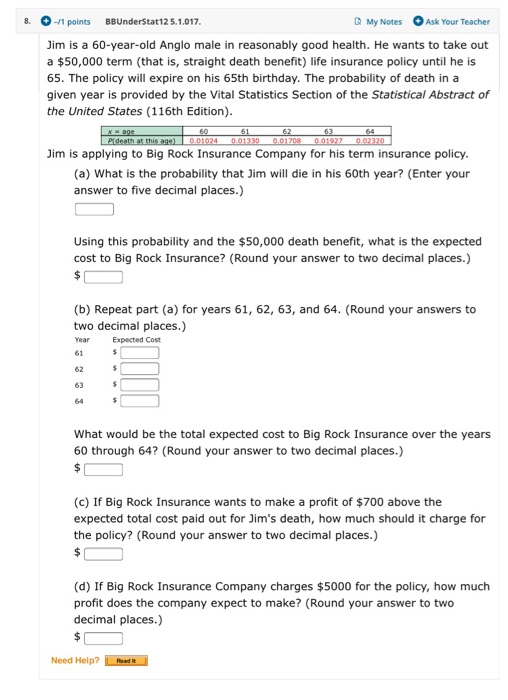

8. -11 points BBUnderStat12 5.1.017. My Notes Ask Your Teacher Jim is a 60-year-old Anglo male in reasonably good health. He wants to take out a $50,000 term (that is, straight death benefit) life insurance policy until he is 65. The policy will expire on his 65th birthday. The probability of death in a given year is provided by the Vital Statistics Section of the Statistical Abstract of the United States (116th Edition). Prdeath at this age 01024002 00120801927002320 Jim is applying to Big Rock Insurance Company for his term insurance policy. (a) What is the probability that Jim will die in his 60th year? (Enter your answer to five decimal places.) Using this probability and the $50,000 death benefit, what is the expected cost to Big Rock Insurance? (Round your answer to two decimal places.) (b) Repeat part (a) for years 61, 62, 63, and 64. (Round your answers to two decimal places.) Year Expected Cost What would be the total expected cost to Big Rock Insurance over the years 60 through 64? (Round your answer to two decimal places.) (c) If Big Rock Insurance wants to make a profit of $700 above the expected total cost paid out for Jim's death, how much should it charge for the policy? (Round your answer to two decimal places.) (d) If Big Rock Insurance Company charges $5000 for the policy, how much profit does the company expect to make? (Round your answer to two decimal places.) Need Help

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts