Question: 8 . 2 3 PM Sun May 1 8 Done kaplanlearn.com I SPS 1 5 OnDemand Retirement Savings and Inceme Planning - Question 3 6

PM Sun May

Done

kaplanlearn.com

I

SPS OnDemand Retirement Savings and Inceme Planning

Question of

Question D:

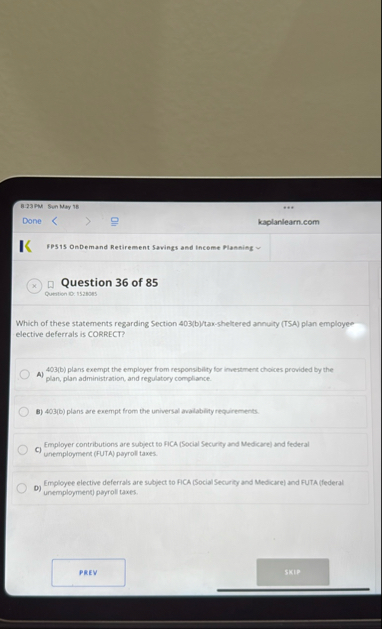

Which of these statements regarding Section btaxsheltered annuity TSA plan employee elective deferrals is CORRECT?

Ab plans exempt the employer from responsibility for invessment choices provided by the plan, plan administration, and regulatory compliance.

Bb plans are exempt from the universal availablity requirements.

C Employer contributions are subject to RCA Social Security and Medicare and federal unemployment FUTA payroll taxes.

D Employee elective deferrals are subject to RICA Social Security and Medicare and FUTA federal unemployment payroll taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock