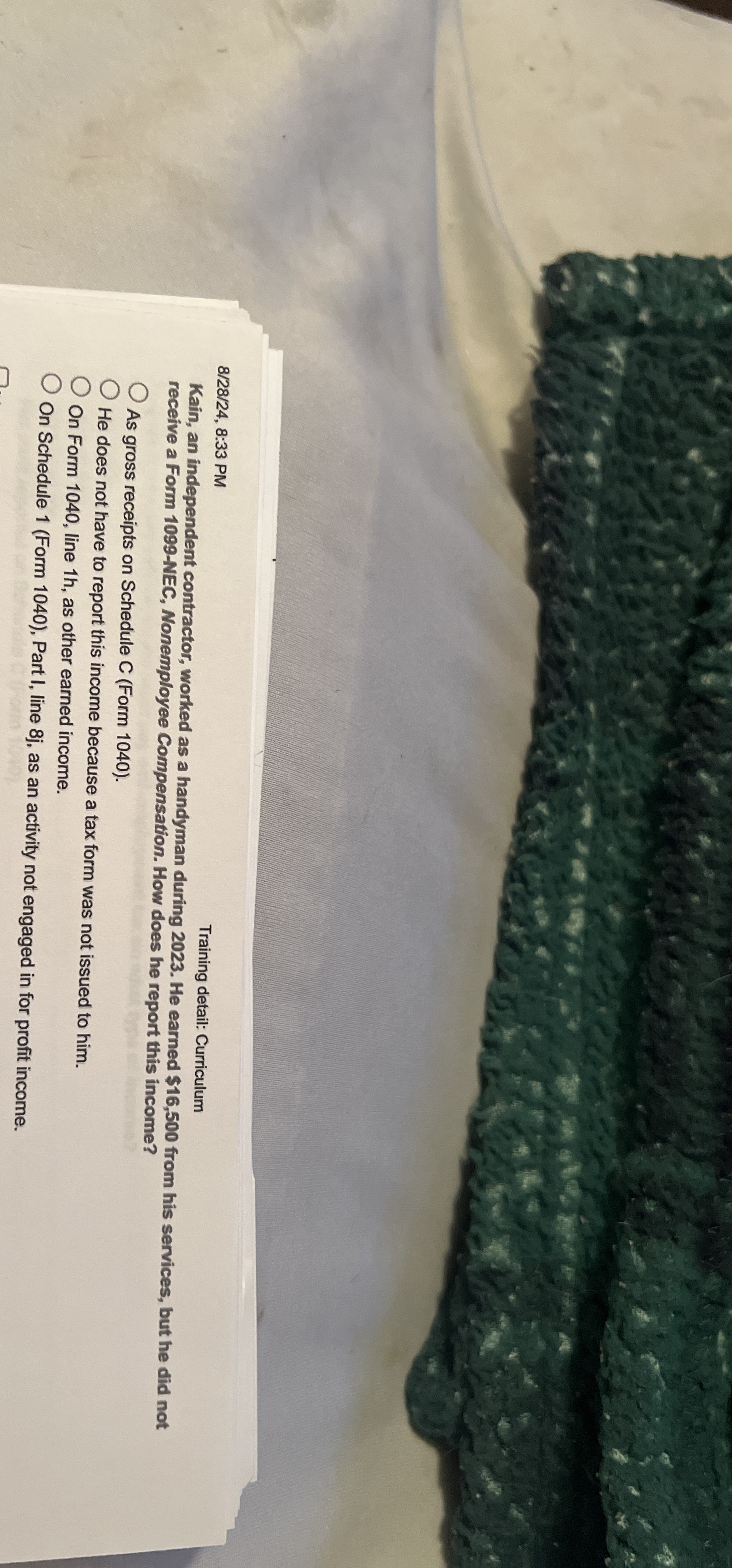

Question: 8 / 2 8 / 2 4 , 8 : 3 3 PM Training detail: Curriculum Kain, an independent contractor, worked as a handyman during

: PM

Training detail: Curriculum

Kain, an independent contractor, worked as a handyman during He earned $ from his services, but he did not receive a Form NEC, Nonemployee Compensation. How does he report this income?

As gross receipts on Schedule C Form

He does not have to report this income because a tax form was not issued to him.

On Form line h as other earned income.

On Schedule Form Part I, line j as an activity not engaged in for profit income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock