Question: 8 . 3 Other Valuation Approaches When is recording inventory at net realizable value permitted, even if it is above cost? There are no significant

Other Valuation Approaches

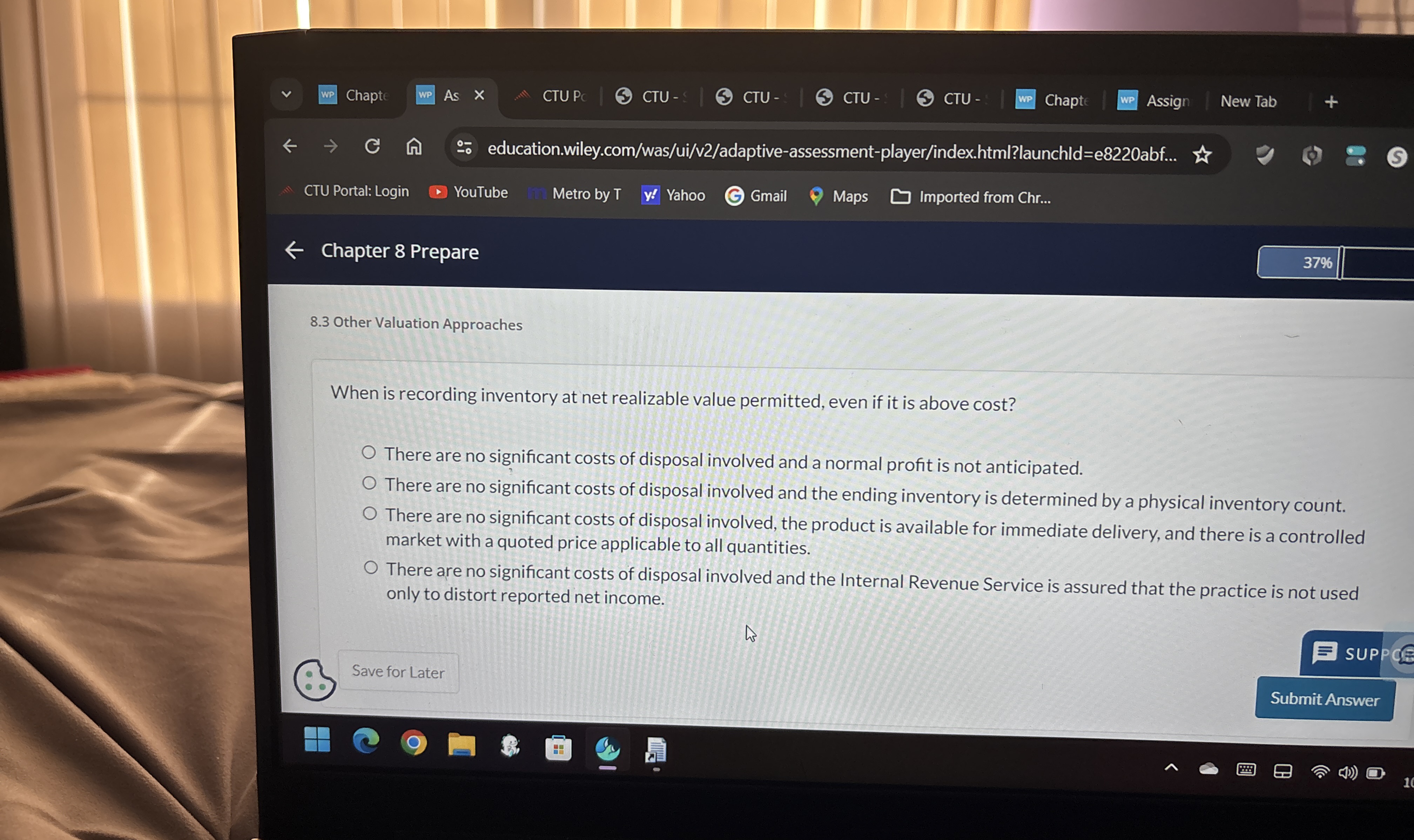

When is recording inventory at net realizable value permitted, even if it is above cost?

There are no significant costs of disposal involved and a normal profit is not anticipated.

There are no significant costs of disposal involved and the ending inventory is determined by a physical inventory count.

There are no significant costs of disposal involved, the product is available for immediate delivery, and there is a controlled

market with a quoted price applicable to all quantities.

There are no significant costs of disposal involved and the Internal Revenue Service is assured that the practice is not used

only to distort reported net income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock