Question: 8 : 5 8 9 5 Back HW Chapter 8 . docx Switch To Light Mode Problem 1 Presented below is an aging schedule for

:

Back

HW Chapter docx

Switch To Light Mode

Problem

Presented below is an aging schedule for Bry

Problem

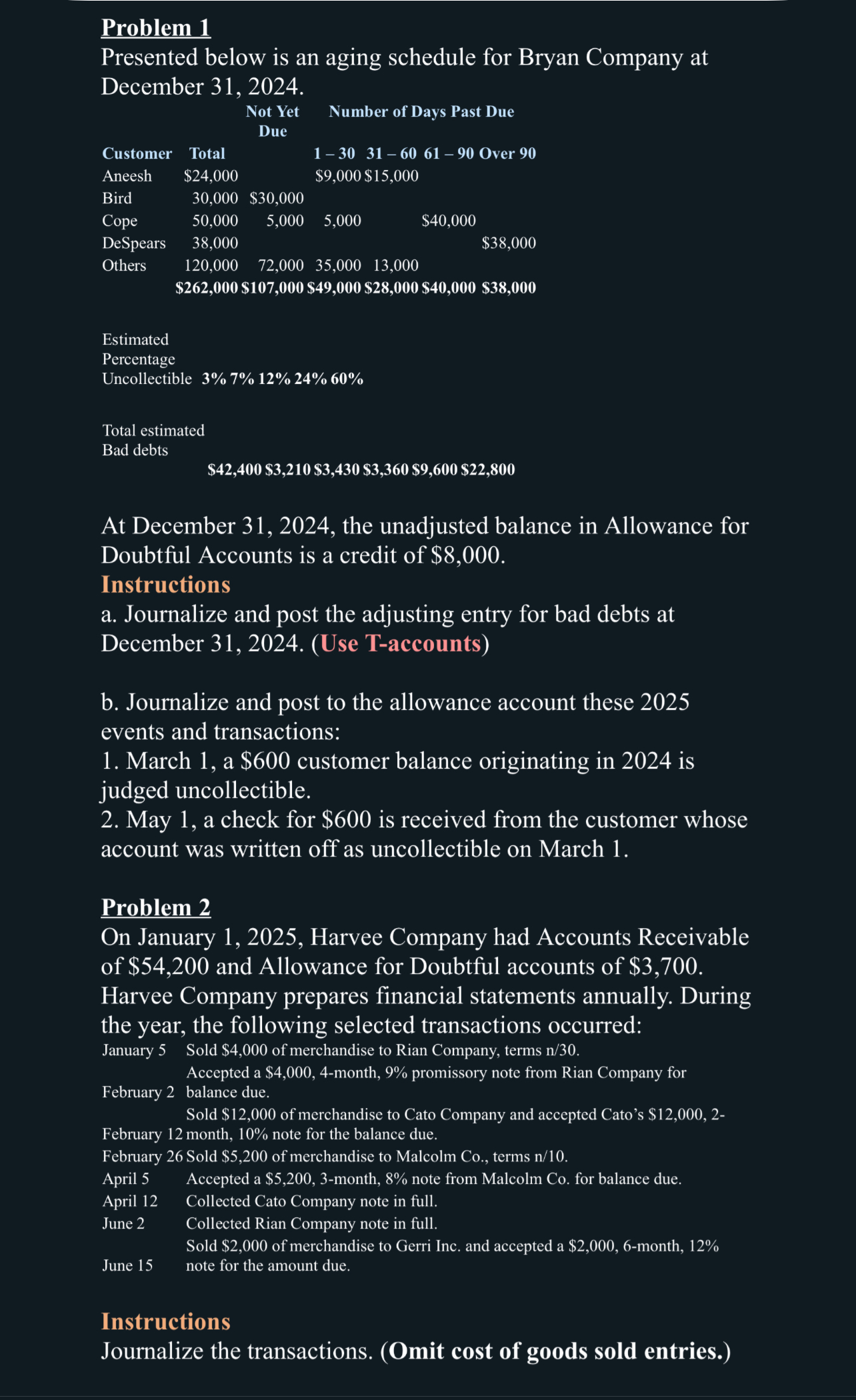

Presented below is an aging schedule for Bryan Company at December

tabletableNot YetDueNumber of DaDays Past DueCustomerTotal,, Over Aneesh$$ $Bird$Cope$DeSpears$Others$$$ $ $$ $

Estimated

Percentage

Uncollectible

Total estimated

Bad debts

$ $ $ $ $ $

At December the unadjusted balance in Allowance for Doubtful Accounts is a credit of $

Instructions

a Journalize and post the adjusting entry for bad debts at December Use Taccounts

b Journalize and post to the allowance account these events and transactions:

March a $ customer balance originating in is judged uncollectible.

May a check for $ is received from the customer whose account was written off as uncollectible on March

Problem

On January Harvee Company had Accounts Receivable of $ and Allowance for Doubtful accounts of $

Harvee Company prepares financial statements annually. During the year, the following selected transactions occurred:

January Sold $ of merchandise to Rian Company, terms n

Accepted a $month, promissory note from Rian Company for

February balance due.

Sold $ of merchandise to Cato Company and accepted Cato's $

February month, note for the balance due.

February Sold $ of merchandise to Malcolm Co terms n

April Accepted a $month, note from Malcolm Co for balance due.

April Collected Cato Company note in full.

June Collected Rian Company note in full.

Sold $ of merchandise to Gerri Inc. and accepted a $month,

June note for the amount due.

Instructions

Journalize the transactions. Omit cost of goods sold entries.an Company at December

tableNot Yet Due,Number of Days Past DueCustomerTotal, Over Aneesh$$ $Bird$Cope$DeSpears$Others

$ $ $ $ $ $

Estimated

Percentage

Uncollectible

Total estimated

Bad debts

$ $ $ $ $ $

At December the unadjusted balance in Allowance for Doubtful Accounts is a credit of $

Instructions

a Journalize and post the adjusting entry for bad debts at December Use Taccounts

b Journalize and post to the allowance account these events and transactions:

March a $ customer balance originating in is judged uncollectible.

May a check for $ is received from the customer whose account was written off as uncollectible on March

Problem

On January Harvee Company had Accounts Receivable of $ and Allowance for Doubtful accounts of $

Harvee Company prepares financial statements annually. During the year, the following selected transactions occurred:

January Sold $ of merchandise to Rian Company, terms n

Accepted a $month, promissory note from Rian Company for

February balance due.

Sold $ of merchandise to Cato Company and accepted Cato's $

February month, note for the balance due.

February Sold $ of merchandise to Malcolm Co terms n

April Accepted a $month, note from Malcolm Co for balance due.

April Collected Cato Company note in full.

June Collected Rian Company note in full.

Sold $ of merchandise to Gerri Inc. and accepted a $month,

June note for the amount due.

Instructions

Journalize the transactions. Omit cost of goods sold entries.

Dashboard

Calendar

To Do

Notifications

Inbox

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock