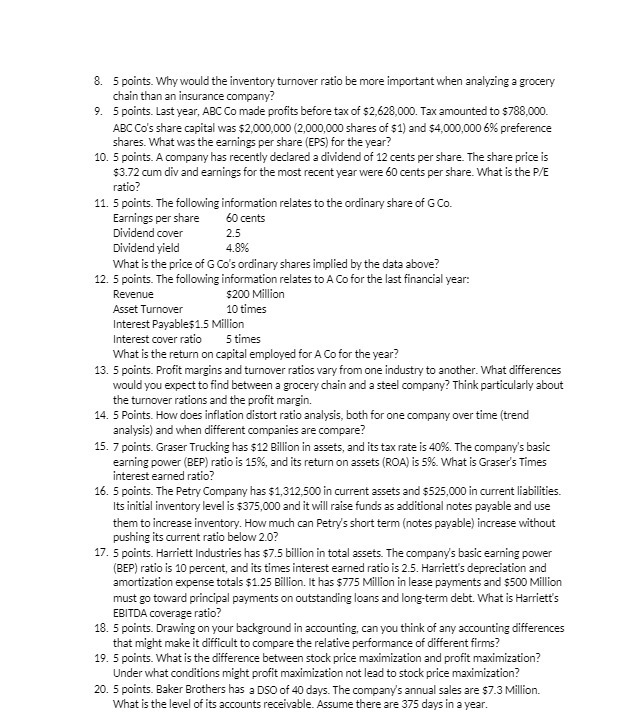

Question: 8. 5 points. Why would the inventory turnover ratio be more important when analyzing a grocery chain than an insurance company? 9. 5 points. Last

8. 5 points. Why would the inventory turnover ratio be more important when analyzing a grocery chain than an insurance company? 9. 5 points. Last year, ABC Co made profits before tax of $2,628,000. Tax amounted to $788,000. ABC Co's share capital was $2,000,000 (2,000,000 shares of $1) and $4,000,000 6% preference shares. What was the earnings per share (EPS) for the year? 10. 5 points. A company has recently declared a dividend of 12 cents per share. The share price is $3.72 cum div and earnings for the most recent year were 60 cents per share. What is the P/E ratio? 11. 5 points. The following information relates to the ordinary share of G Co. Earnings per share 60 cents Dividend cover 2.5 Dividend yield 4.8% What is the price of G Co's ordinary shares implied by the date above? 12. 5 points. The following information relates to A Co for the last financial year: Revenue $200 Million Asset Turnover 10 times Interest Payable$1.5 Million Interest cover ratio 5 times What is the return on capital employed for A Co for the year? 13. 5 points. Profit margins and turnover ratios vary from one industry to another. What differences would you expect to find between a grocery chain and a steel company? Think particularly about the turnover rations and the profit margin. 14. 5 Points. How does inflation distort ratio analysis, both for one company over time (trend analysis) and when different companies are compare? 15. 7 points. Graser Trucking has $12 Billion in assets, and its tax rate is 40%%. The company's basic earning power (BEP) ratio is 15%, and its return on assets (ROA) is 5%. What is Graser's Times interest earned ratio? 16. 5 points. The Petry Company has $1,312,500 in current assets and $525,000 in current liabilities. Its initial inventory level is $375,000 and it will raise funds as additional notes payable and use them to increase inventory. How much can Petry's short term (notes payable) increase without pushing its current ratio below 2.0? 17. 5 points. Harriett Industries has $7.5 billion in total assets. The company's basic earning power (BEP) ratio is 10 percent, and its times interest earned ratio is 2.5. Harriett's depreciation and amortization expense totals $1.25 Billion. It has $775 Million in lease payments and $500 Million must go toward principal payments on outstanding loans and long-term debt. What is Harriett's EBITDA coverage ratio? 18. 5 points. Drawing on your background in accounting, can you think of any accounting differences that might make it difficult to compare the relative performance of different firms? 19. 5 points. What is the difference between stock price maximization and profit maximization? Under what conditions might profit maximization not lead to stock price maximization? 20. 5 points. Baker Brothers has a DSO of 40 days. The company's annual sales are $7.3 Million. What is the level of its accounts receivable. Assume there are 375 days in a year