Question: 8. 6. 12. PART B: MULTIPLE CHOICE. USE THE ANSWER SHEET PROVIDED BEOw 1. Consider an investor who welcomes above-average portfolio risk. Which of the

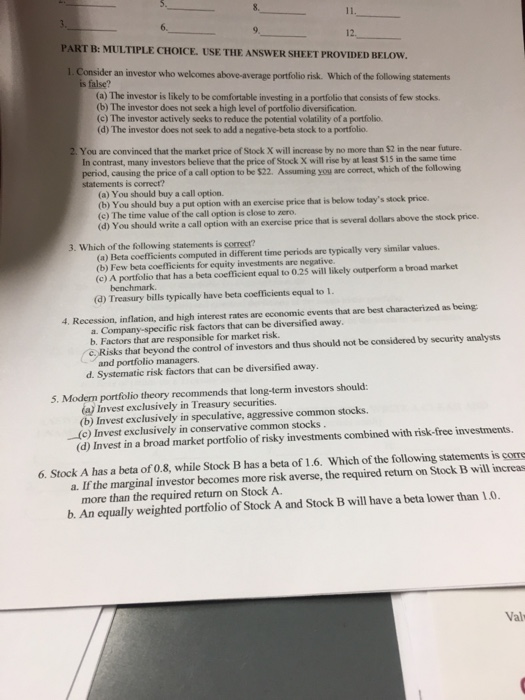

8. 6. 12. PART B: MULTIPLE CHOICE. USE THE ANSWER SHEET PROVIDED BEOw 1. Consider an investor who welcomes above-average portfolio risk. Which of the folloving staterments false? (a) The investor is likely to be comfortable investing in a portfolio that consists of few stocks. (b) The investor does not seek a high level of portfolio diversification (c) The investor actively seeks to reduce the potential volatility of a portfolio. (d) The investor does not seek to add a negative-beta stock to a portfolio. You are convinced that the market price of Stock X will increase by no more than $2 in the near future In contrast, many investors believe that the price of Stock X will rise by at least $15 in the same time period, causing the price of a call option to be $22. Assuming you are correct, which of the statements is correct? (a) You should buy a call option. (b) You should buy a put option with an exercise price that is below today's stock price. (c) The time value of the call option is close to zero. (d) You should write a call option with an exercise price that is several dollars above the stock price 3. Which of the following statements is correst? (a) Beta coefficients computed in different time periods are typically very similar values (b) Few beta coefficients for equity investments are negative. (c) A portfolio that has a beta coefficient equal to 0.25 will likely outperform a broad market benchmark (d) Treasury bills typically have beta coefficients equal to l 4. Recession, inflation, and high interest rates are economic events that are best characterized as being a. Company-specific risk factors that can be diversified away b. Factors that are responsible for market risk. C Risks that beyond the control of investors and thus should not be considered by security analysts and portfolio managers. d. Systematic risk factors that can be diversified away 5. Modern portfolio theory recommends that long-term investors should: a) Invest exclusively in Treasury securities. (b) Invest exclusively in speculative, aggressive common stocks. (c) invest exclusively in conservative common stocks (d) Invest in a broad market portfolio of risky investments combined with risk-free investments. 6. Stock A has a beta of 0.8, while Stock B has a beta of 1.6. Which of the following statements is corre a. If the marginal investor becomes more risk averse, the required return on Stock B will increas b. An equally weighted portfolio of Stock A and Stock B will have a beta lower than 1.0. more than the required return on Stock A Val

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts