Question: 8 7 6 8 9 0 Chapter 13 1. Special Order Decision (accept or reject) We could accept a special order at $50 per unit

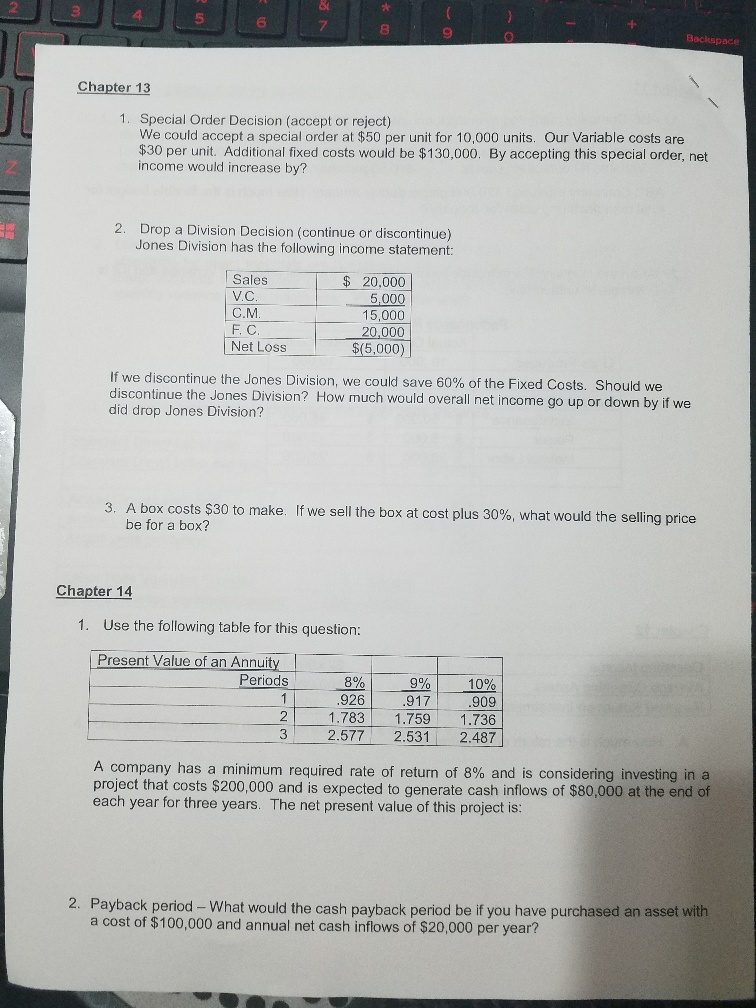

8 7 6 8 9 0 Chapter 13 1. Special Order Decision (accept or reject) We could accept a special order at $50 per unit for 10,000 units. Our Variable costs are $30 per unit. Additional fixed costs would be $130,000. By accepting this special order, net income would increase by? 2. Drop a Division Decision (continue or discontinue) Jones Division has the following income statement: Sales V.C C.M F. C 20,000 5,000 15,000 20,000 Net Loss$(5,000) lf we discontinue the Jones Division, we could save 60% of the Fixed Costs. Should we discontinue the Jones Division? How much would overall net income go up or down by if we did drop Jones Division? 3, A box costs $30 to make. If we sell the box at cost plus 30%, what would the selling price be for a box? Chapter 14 1. Use the following table for this question: Present Value of an Annu Periods 8901 926 990 917 10% 909 1.783 1.759 1.736 2.577 2.531 2.487 A company has a minimum required rate of return of 8% and is considering investing in a project that costs $200,000 and is expected to generate cash inflows of $80,000 at the end of each year for three years. The net present value of this project is: 2. Payback period - What would the cash payback period be if you have purchased an asset with a cost of $100,000 and annual net cash inflows of $20,000 per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts