Question: 8 . 7 % Question 1 4 2 pts Now consider an alternative asset pricing model ( the Fama - French 3 - Factor model

Question

pts

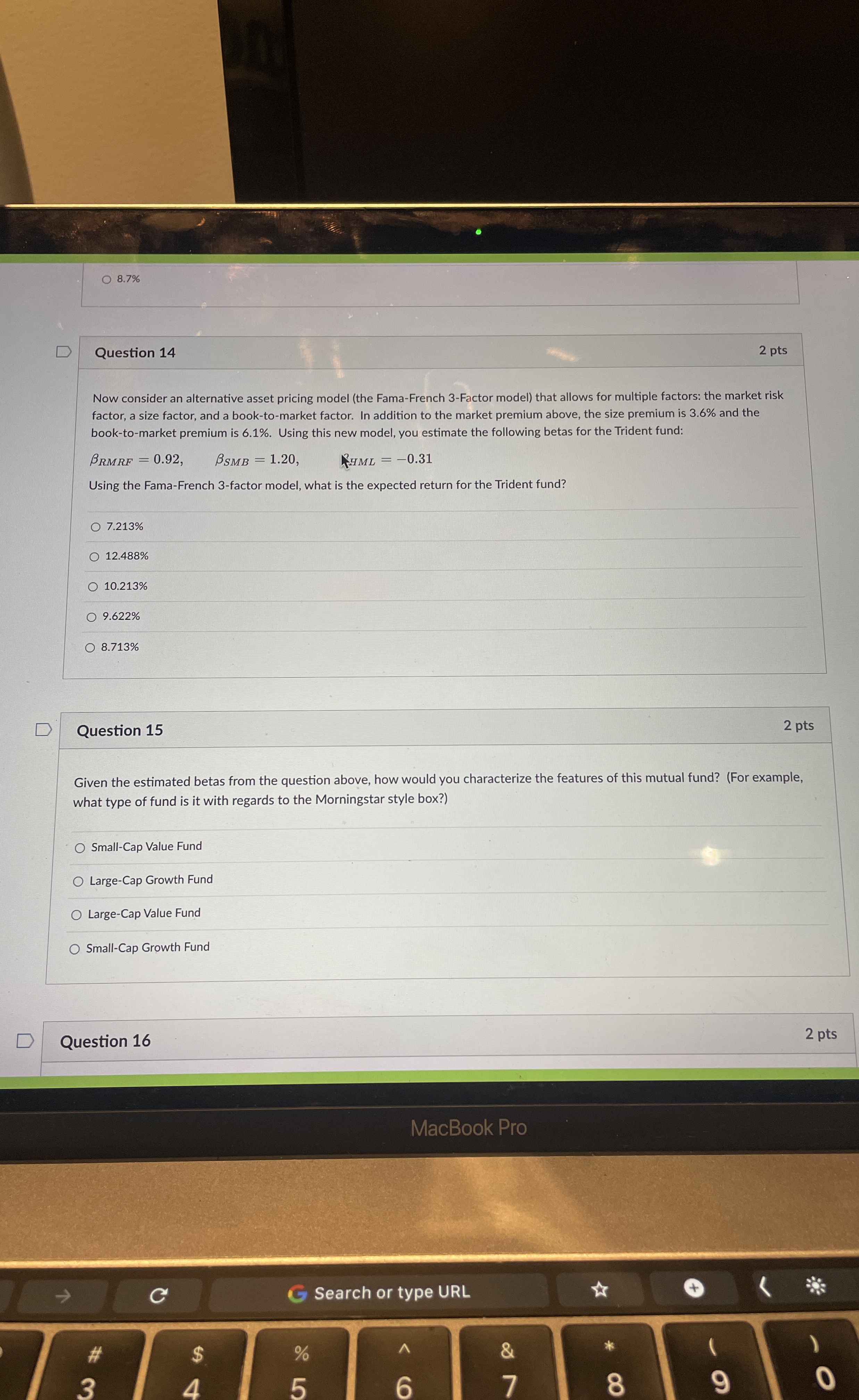

Now consider an alternative asset pricing model the FamaFrench Factor model that allows for multiple factors: the market risk factor, a size factor, and a booktomarket factor. In addition to the market premium above, the size premium is and the booktomarket premium is Using this new model, you estimate the following betas for the Trident fund:

Using the FamaFrench factor model, what is the expected return for the Trident fund?

Question ptsMacBook ProSearch or type URL

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock