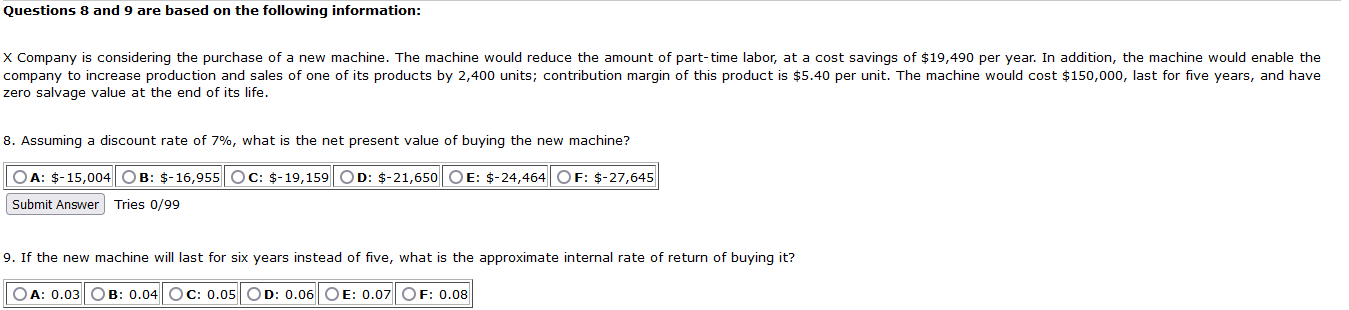

Question: 8 & 9 please! Questions 8 and 9 are based on the following information: x Company is considering the purchase of a new machine. The

8 & 9 please!

Questions 8 and 9 are based on the following information: x Company is considering the purchase of a new machine. The machine would reduce the amount of part-time labor, at a cost savings of $19,490 per year. In addition, the machine would enable the company to increase production and sales of one of its products by 2,400 units; contribution margin of this product is $5.40 per unit. The machine would cost $150,000, last for five years, and have zero salvage value at the end of its life. 8. Assuming a discount rate of 7%, what is the net present value of buying the new machine? OA: $-15,004 OB: $-16,955 Oc: $-19,159 OD: $-21,650 OE: $-24,464 F: $-27,645 Submit Answer Tries 0/99 9. If the new machine will last for six years instead of five, what is the approximate internal rate of return of buying it? OA: 0.03 OB: 0.04 OC: 0.05 OD: 0.06 OE: 0.07 OF: 0.08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts