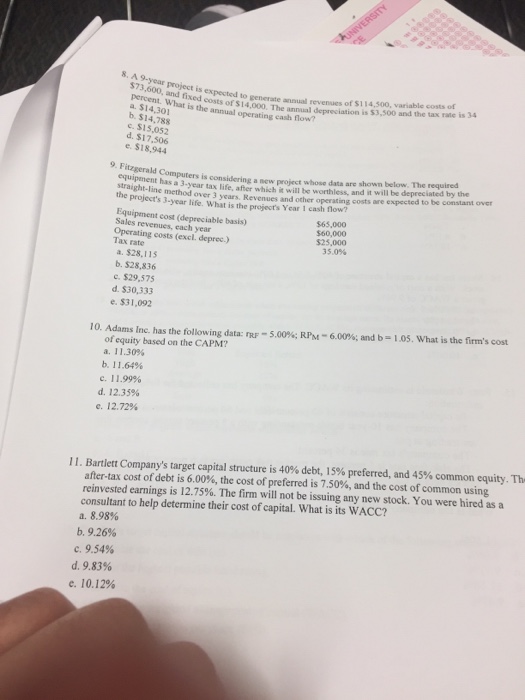

Question: 8. A 9-year project is expected to generate 00, and fixed xpected to generate annual revenues of $114,500, variable costs of percent. What is the

8. A 9-year project is expected to generate 00, and fixed xpected to generate annual revenues of $114,500, variable costs of percent. What is the annual operating cash f a. $14,301 b. $14,788 c. $15,052 d. $17,506 e. $18,944 usts of s14,000, The annual depreciation is $3,500 and the tax rate is 34 9. Fitzgerald Computers is considering a new project whose data are shown below. The required his ??-year tax life, after which, will be worthless, and it will be depreciated by the the projstrs method over 3 years, Revenues and other operating costs are expecied to be constant over ine project's 3-year life. What is the project's Year 1 cash flow? Equipment cost (depreciable basis) Sales revenues, each year Operating costs (excl. deprec.) Tax rate a. $28.11 S b.$28,836 e.$29,57 d. $30,333 e. $31,092 $65,000 $60,000 $25,000 35.0% 5.00%; RPM 6,00%; and b-105. What is the firm's cost 10. Adams Inc. has the follow gdata F of equity based on the CAPM? a. 11.30% b. 11.64% c. 11.99% d. 12.35% e. 12.72% 1 1 . Bartlett Company's target capital structure is 40% debt, l 5% preferred, and 45% common equity. Th after-tax cost of debt is 6.00%, the cost of preferred is 7.50%, and the cost of common using reinvested earnings is 12.75%. The firm will not be issuing any new stock. You were hired as a consultant to help determine their cost of capital. What is its WACC? a. 8.98% b. 9.26% c. 9.54% d. 9.83% e. 10.12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts