Question: 8. a b. c. 9 9. a Cisco has a beta of 90 and Microsoft has a beta of .87. If the CAPM is correct,

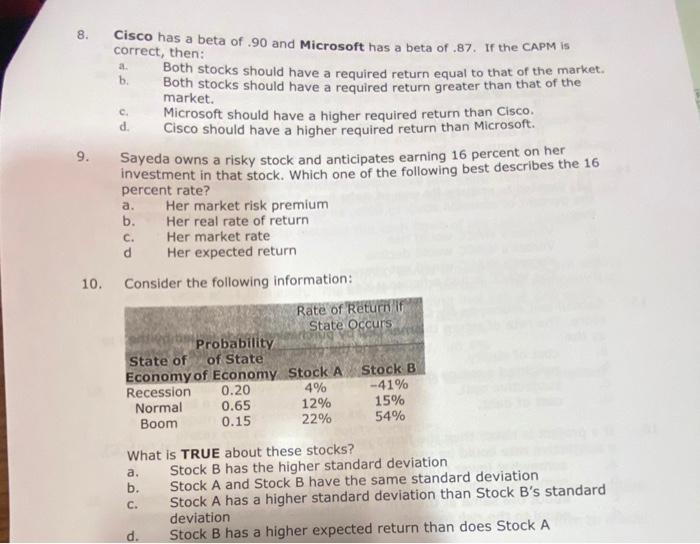

8. a b. c. 9 9. a Cisco has a beta of 90 and Microsoft has a beta of .87. If the CAPM is correct, then: Both stocks should have a required return equal to that of the market. Both stocks should have a required return greater than that of the market. Microsoft should have a higher required return than Cisco. d. Cisco should have a higher required return than Microsoft. Sayeda owns a risky stock and anticipates earning 16 percent on her investment in that stock. Which one of the following best describes the 16 percent rate? Her market risk premium b. Her real rate of return Her market rate d Her expected return Consider the following information: Rate of Return it State Occurs Probability State of of State Economy of Economy Stock A Stock B Recession 0.20 4% -41% Normal 0.65 12% 15% Boom 0.15 22% 54% C. 10. What is TRUE about these stocks? a. Stock B has the higher standard deviation b. Stock A and Stock B have the same standard deviation C. Stock A has a higher standard deviation than Stock B's standard deviation d. Stock B has a higher expected return than does Stock A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts