Question: 8. A disclosure note from Deere's 10K for the 2022 fiscal year (ended on 10/30/2022 ) is listed below. Use this disclosure note to answer

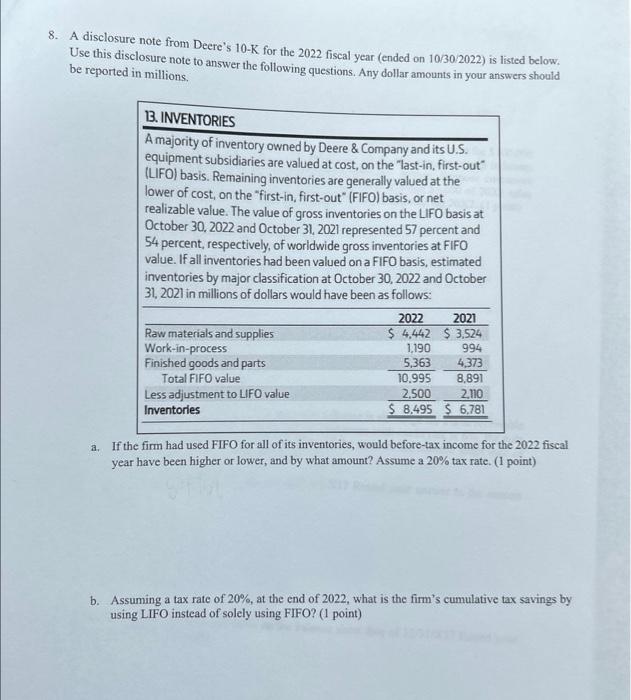

8. A disclosure note from Deere's 10K for the 2022 fiscal year (ended on 10/30/2022 ) is listed below. Use this disclosure note to answer the following questions. Any dollar amounts in your answers should be reported in millions. a. If the firm had used FIFO for all of its inventories, would before-tax income for the 2022 fiscal year have been higher or lower, and by what amount? Assume a 20% tax rate. ( 1 point) b. Assuming a tax rate of 20%, at the end of 2022 , what is the firm's cumulative tax savings by using LIFO instead of solely using FIFO? ( 1 point)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock