Question: 8) A S1,000 face value coupon bond will pay 5 percent interest annually for 12 years. What is the percentage change in the price of

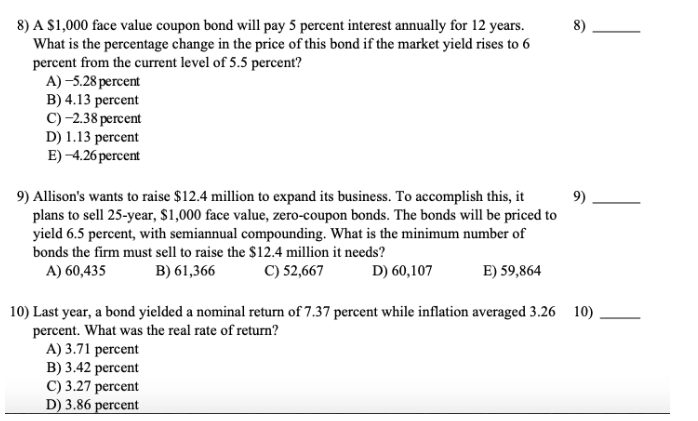

8) A S1,000 face value coupon bond will pay 5 percent interest annually for 12 years. What is the percentage change in the price of this bond if the market yield rises to 6 percent from the current level of 5.5 percent? A) -5.28 percent B) 4.13 percent C)-2.38 percent D) 1.13 percent E)-4.26percent 8) 9) Allison's wants to raise $12.4 million to expand its business. To accomplish this, it plans to sell 25-year, $1,000 face value, zero-coupon bonds. The bonds will be priced to yield 6.5 percent, with semiannual compounding. What is the minimum number of bonds the firm must sell to raise the $12.4 million it needs? 9) A) 60,435 B) 61,366 C) 52,667 D) 60,107 E) 59,864 10) Last year, a bond yielded a nominal return of 7.37 percent while inflation averaged 3.26 percent. What was the real rate of return? A) 3.71 percent B) 3.42 percent C) 3.27 percent D) 3.86 percent 10)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts