Question: 8. Accounts receivable Aa Aa E Effective credit management involves establishing credit standards for extending credit to customers, determining the company's terms of credit, and

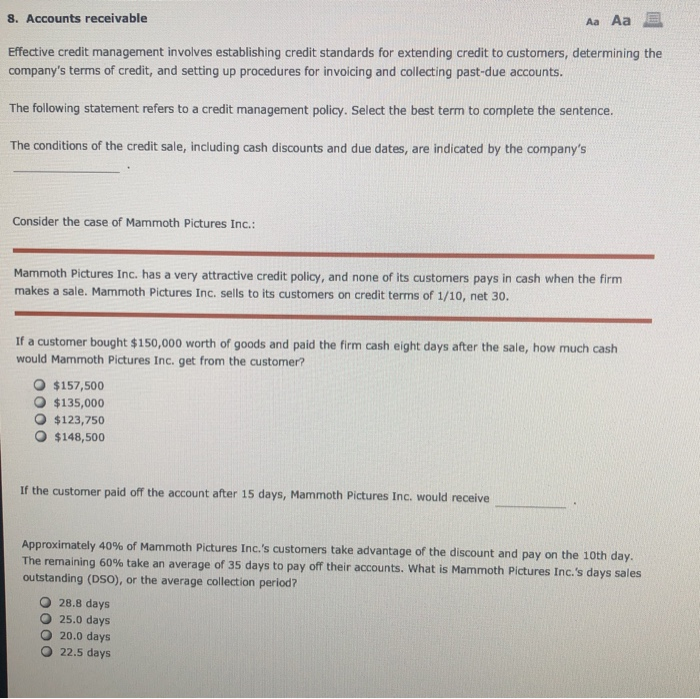

8. Accounts receivable Aa Aa E Effective credit management involves establishing credit standards for extending credit to customers, determining the company's terms of credit, and setting up procedures for invoicing and collecting past-due accounts. The following statement refers to a credit management policy. Select the best term to complete the sentence. The conditions of the credit sale, including cash discounts and due dates, are indicated by the company's Consider the case of Mammoth Pictures Inc.: Mammoth Pictures Inc. has a very attractive credit policy, and none of its customers pays in cash when the firm makes a sale. Mammoth Pictures Inc. sells to its customers on credit terms of 1/10, net 30. If a customer bought $150,000 worth of goods and paid the firm cash eight days after the sale, how much cash would Mammoth Pictures Inc. get from the customer? O $157,500 $135,000 $123,750 $148,500 O O If the customer paid off the account after 15 days, Mammoth Pictures Inc. would receive Approximately 40% of Mammoth Pictures Inc.'s customers take advantage of the discount and pay on the 10th day. The remaining 60% take an average of 35 days to pay off their accounts. What is Mammoth Pictures Inc.'s days sales outstanding (DSO), or the average collection period? 28.8 days 25.0 days 20.0 days O 22.5 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts