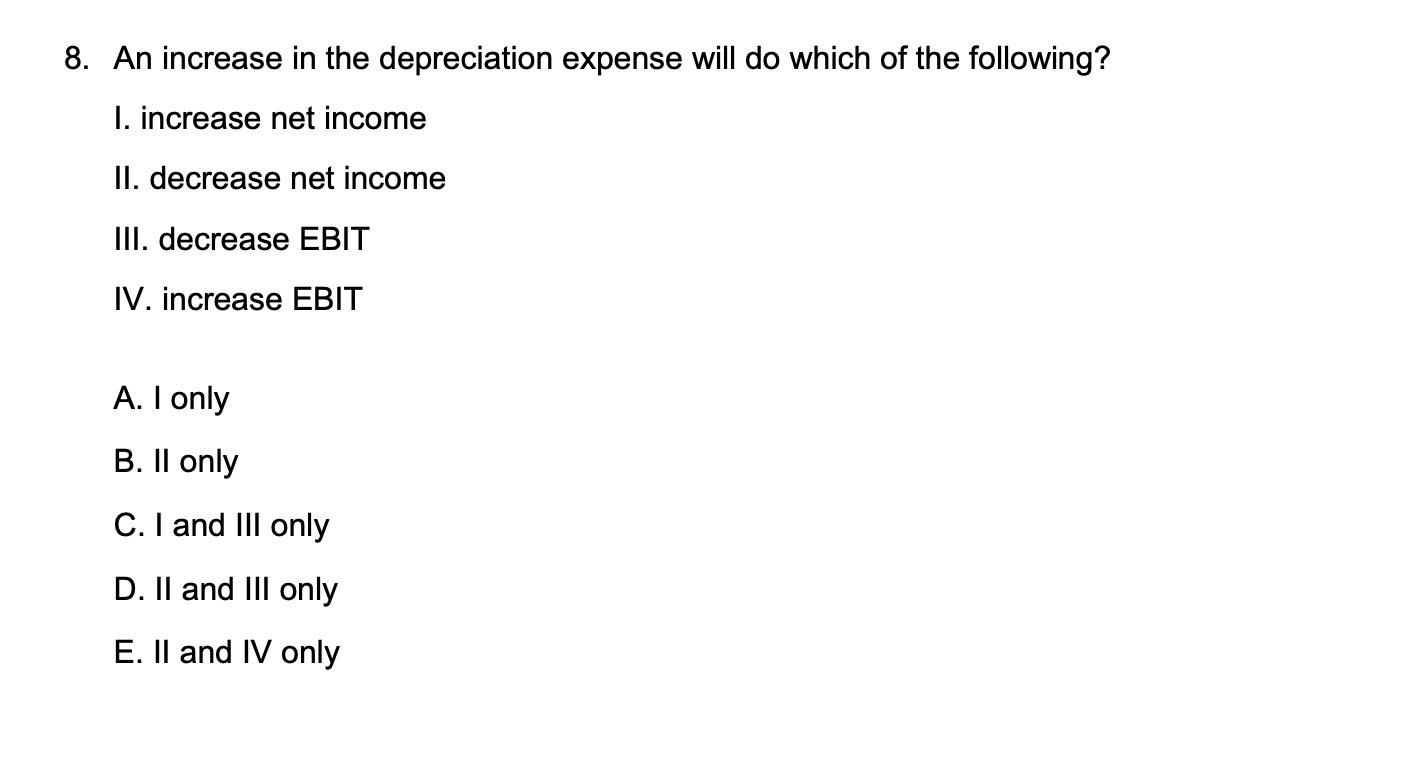

Question: 8. An increase in the depreciation expense will do which of the following? I. increase net income II. decrease net income III. decrease EBIT IV.

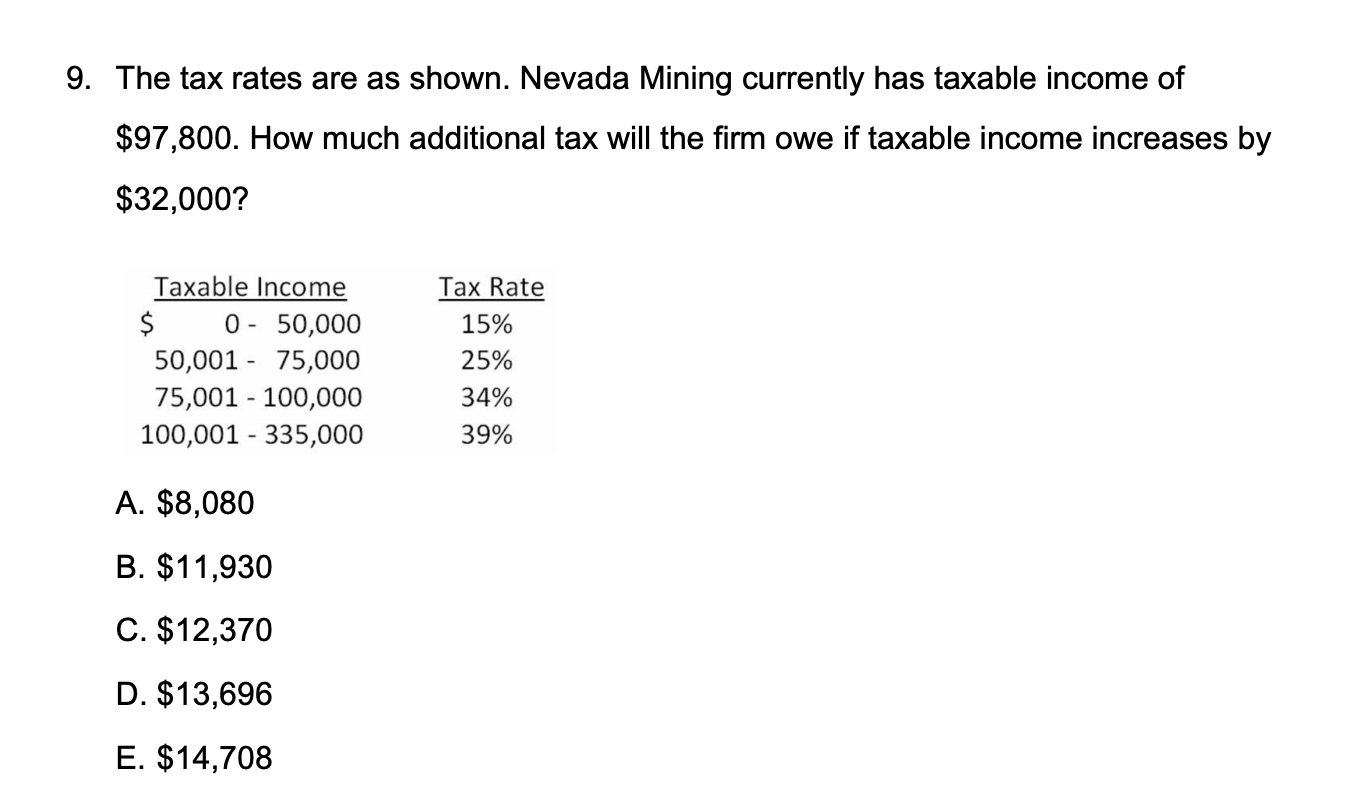

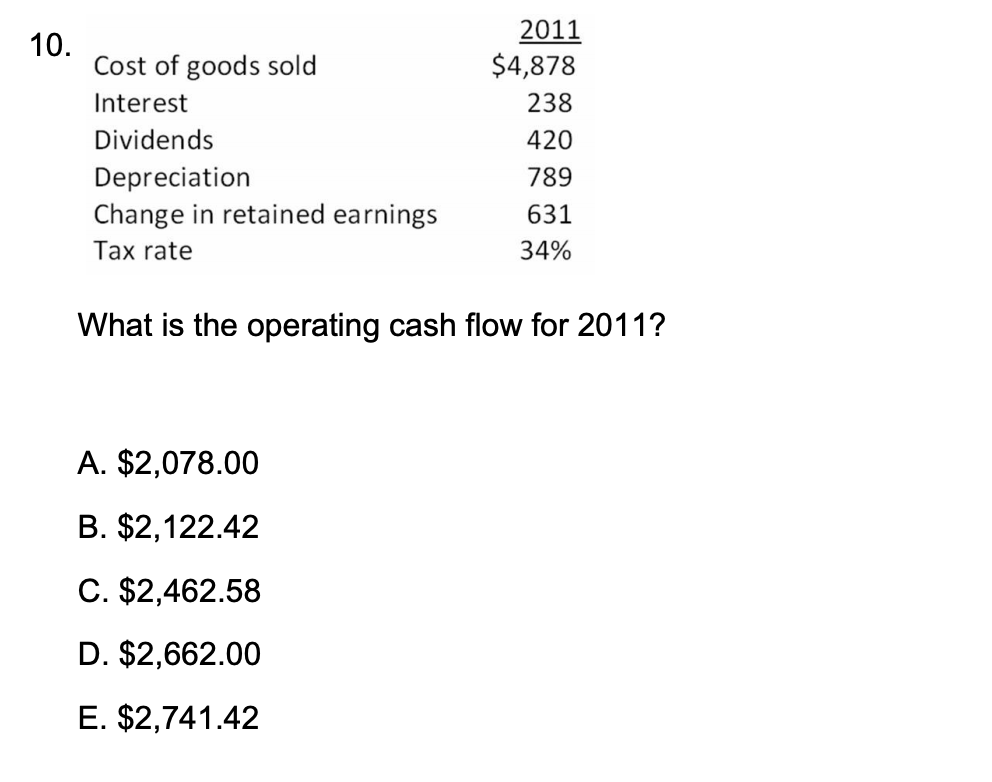

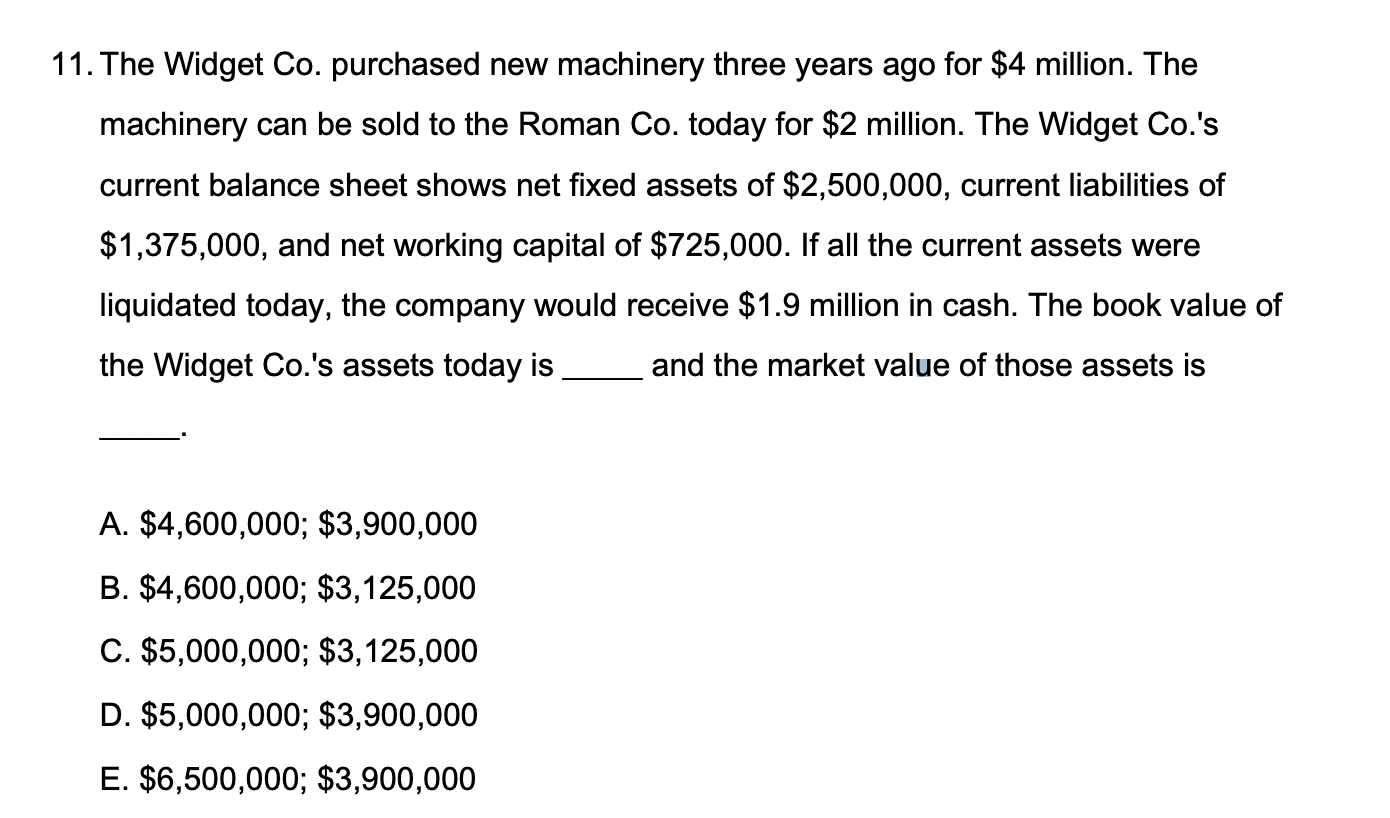

8. An increase in the depreciation expense will do which of the following? I. increase net income II. decrease net income III. decrease EBIT IV. increase EBIT A. I only B. Il only C. I and III only D. II and III only E. II and IV only 9. The tax rates are as shown. Nevada Mining currently has taxable income of $97,800. How much additional tax will the firm owe if taxable income increases by $32,000? $ Taxable Income 0 - 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 335,000 Tax Rate 15% 25% 34% 39% A. $8,080 B. $11,930 C. $12,370 D. $13,696 E. $14,708 10. Cost of goods sold Interest Dividends Depreciation Change in retained earnings Tax rate 2011 $4,878 238 420 789 631 34% What is the operating cash flow for 2011? A. $2,078.00 B. $2,122.42 C. $2,462.58 D. $2,662.00 E. $2,741.42 11. The Widget Co. purchased new machinery three years ago for $4 million. The machinery can be sold to the Roman Co. today for $2 million. The Widget Co.'s current balance sheet shows net fixed assets of $2,500,000, current liabilities of $1,375,000, and net working capital of $725,000. If all the current assets were liquidated today, the company would receive $1.9 million in cash. The book value of the Widget Co.'s assets today is and the market value of those assets is A. $4,600,000; $3,900,000 B. $4,600,000; $3,125,000 C. $5,000,000; $3,125,000 D. $5,000,000; $3,900,000 E. $6,500,000; $3,900,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts