Question: 8 (Appendix 48) Direct Method of Support Department Cost Allocation Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates

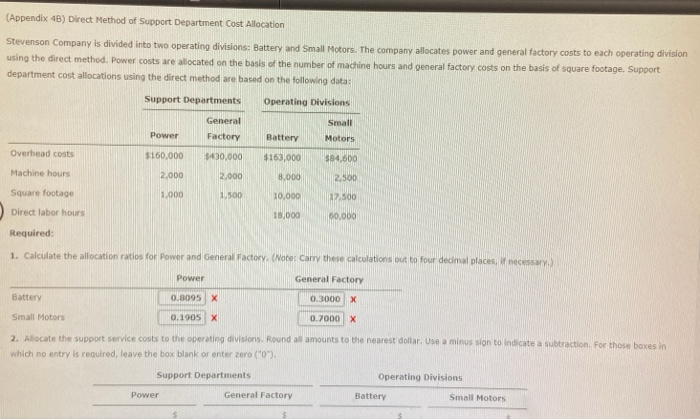

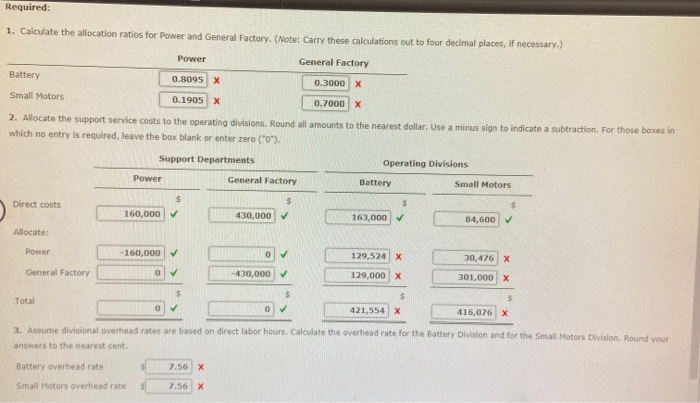

(Appendix 48) Direct Method of Support Department Cost Allocation Stevenson Company is divided into two operating divisions: Battery and Small Motors. The company allocates power and general factory costs to each operating division using the direct method. Power costs are allocated on the basis of the number of machine hours and general factory costs on the basis of square footage. Support department cost allocations using the direct method are based on the following data: Support Departments Operating Divisions General Small Power Factory Motors Battery $163,000 Overhead costs $160.000 $430,000 94,500 Machine hours 2.000 2000 8.000 2.500 Square footage 1.000 12.500 ) Direct labor hours 10,000 10,000 50,000 Required: 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places necessary Power General Factory Battery 0.8095 03000 x Small Motors 0.1905 0.7000 x 2. Allocate the support service costs to the operating divisions. Round all amounts to the nearest dollar. Use a minus sign to indicate a subtraction. For those boxes in which no entry is required, leave the box blank or enter zero ("0"). Support Departments Operating Divisions Power General Factory Battery Small Motors Required: 1. Calculate the allocation ratios for Power and General Factory. (Note: Carry these calculations out to four decimal places, if necessary.) Power General Factory Battery 0.8095 0.3000 x Small Motors 0.1905 X 0.7000 2. Allocate the support service costs to the operating divisions. Round all amounts to the nearest dollar. Use a minus sign to indicate a subtraction. For those boxes in which no entry is required, leave the box blank or enter zero ("0). Support Departments Operating Divisions Power General Factory Battery Small Motors Direct costs 160,000 430,000 163,000 84,600 Allocate: Power - 160,000 129,524 X 30.476 x General Factory -430.000 129,000 X 301,000 Total 421,554 416,076 X 3. Assume divisional overhead rates are based on direct labor hours. Calculate the overhead rate for the Battery Division and for the Small Motors Division, Round your answers to the nearest cent. Battery overhead rate S7.56 Small Motors overhead rates 7.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts