Question: 8. Based on past trend, it is estimated that MSFT will pay a dividend of $2.29 in 2021 (Year 1). (NOTE: This does NOT match

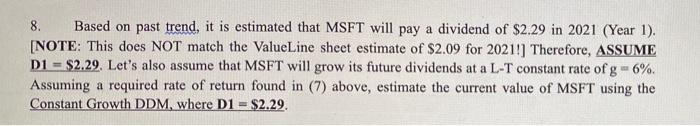

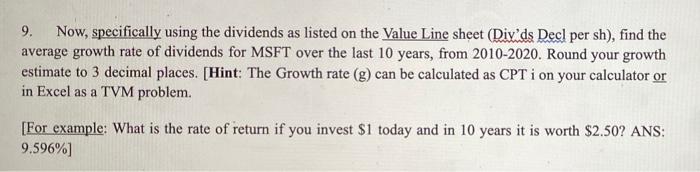

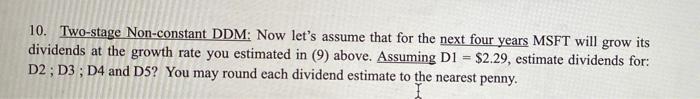

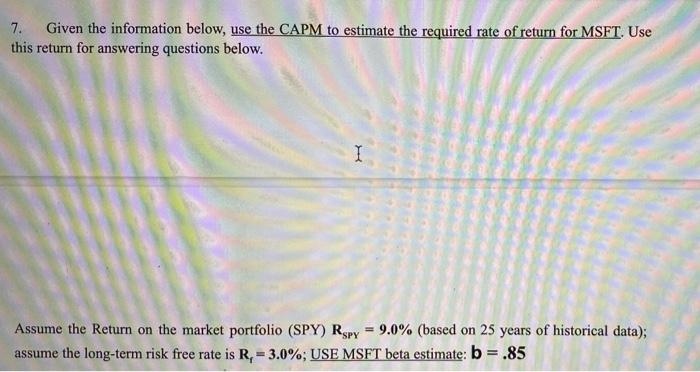

8. Based on past trend, it is estimated that MSFT will pay a dividend of $2.29 in 2021 (Year 1). (NOTE: This does NOT match the ValueLine sheet estimate of $2.09 for 2021!) Therefore, ASSUME D1 = $2.29. Let's also assume that MSFT will grow its future dividends at a L-T constant rate of g -6%. Assuming a required rate of return found in (7) above, estimate the current value of MSFT using the Constant Growth DDM, where D1 = - $2.29. 9. Now, specifically using the dividends as listed on the Value Line sheet (Divids Decl per sh), find the average growth rate of dividends for MSFT over the last 10 years, from 2010-2020. Round your growth estimate to 3 decimal places. (Hint: The Growth rate (g) can be calculated as CPT i on your calculator or in Excel as a TVM problem. [For example: What is the rate of return if you invest $1 today and in 10 years it is worth $2.50? ANS: 9.596%) 10. Two-stage Non-constant DDM: Now let's assume that for the next four years MSFT will grow its dividends at the growth rate you estimated in (9) above. Assuming D1 = $2.29, estimate dividends for: D2, D3, D4 and DS? You may round each dividend estimate to the nearest penny. 7. Given the information below, use the CAPM to estimate the required rate of return for MSFT. Use this return for answering questions below. I Assume the Return on the market portfolio (SPY) RSPY 9.0% (based on 25 years of historical data); assume the long-term risk free rate is R. = 3.0%; USE MSFT beta estimate: b = .85

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts