Question: 8. Based on the profitability index (PI) rule, should a project with the following cash flows be accepted if the discount rate is 8 percent?

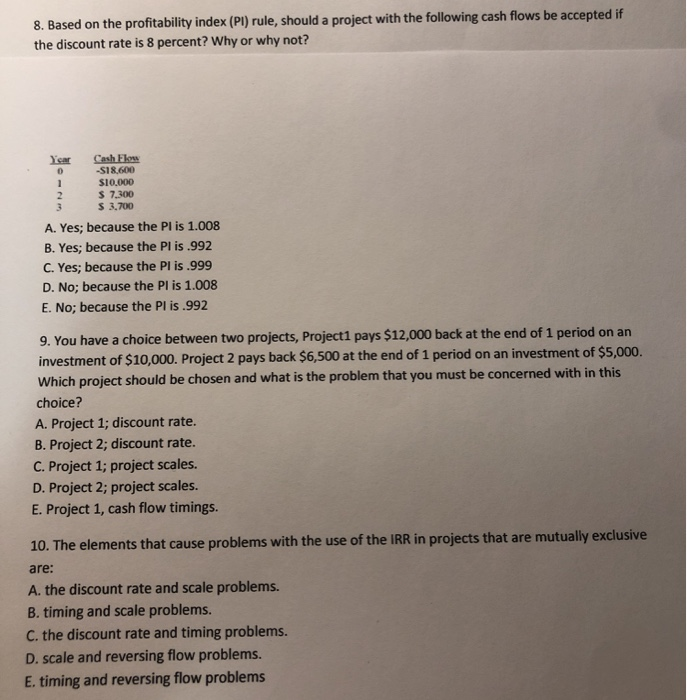

8. Based on the profitability index (PI) rule, should a project with the following cash flows be accepted if the discount rate is 8 percent? Why or why not? Year Cash Flow -S18.600 S10.000 $ 7.300 $ 3.700 A. Yes; because the Pl is 1.008 B. Yes, because the Plis.992 C. Yes, because the Plis.999 D. No; because the Pl is 1.008 E. No; because the Plis.992 9. You have a choice between two projects, Project1 pays $12,000 back at the end of 1 period on an investment of $10,000. Project 2 pays back $6,500 at the end of 1 period on an investment of $5,000. Which project should be chosen and what is the problem that you must be concerned with in this choice? A. Project 1; discount rate. B. Project 2; discount rate. C. Project 1; project scales. D. Project 2; project scales. E. Project 1, cash flow timings. 10. The elements that cause problems with the use of the IRR in projects that are mutually exclusive are: A. the discount rate and scale problems. B. timing and scale problems. C. the discount rate and timing problems. D. scale and reversing flow problems. E. timing and reversing flow problems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts