Question: 8. Calculating an installment loan payment using simple interest Calculating the loan Payment on a Simple-Interest Installment Loan Instaiment loans allow borrowers to repay the

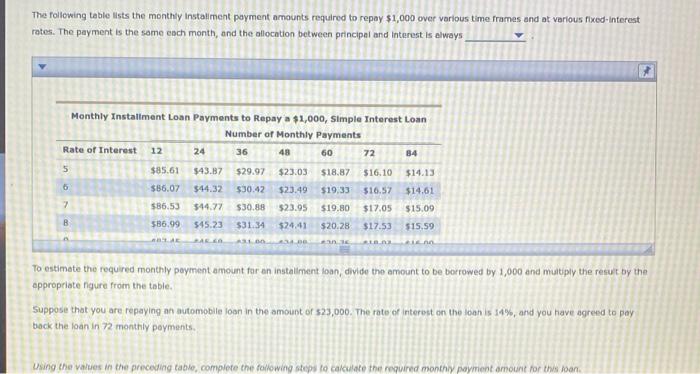

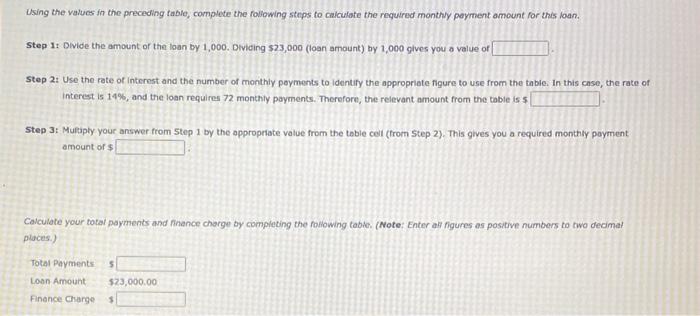

8. Calculating an installment loan payment using simple interest Calculating the loan Payment on a Simple-Interest Installment Loan Instaiment loans allow borrowers to repay the loan with periodic payments over time. They are more common than single-payment loans because it is easier for most people to pay a fixed amount periodically (usually monthly) than budget for paying one big amount in the future. Interest on Installment loans may be computed using the simple interest method or the add-on method. For an installment loan using simple interest and equal payments throughout the We of the loan, a portion of ench repayment is dedicated to the princpal and a portion to the interest. Romember that interest is charged only on the outstanding balance. This means that as each payment is made more of it is located to The following table lists the monthly installment payment amounts required to repay $1,000 over various time frames and at various fixed-interest rates. The payment is the same each month, and the allocation between principal and interest is always The following table lists the monthly installment payment amounts required to repay $1,000 over various time frames and at various fixed Interest rates. The payment is the same each month, and the allocation between principal and interest is always 48 Monthly Installment Loan Payments to Repay a $1,000, Simple Interest Loan Number of Monthly Payments Rate of Interest 12 24 36 60 72 84 5 $85.61 $43.87 $29.97 $23.03 $18.87 $16.10 $14.13 6 $66.07 $44.32 $30.42 $23.49 $19,33 $16.57 $14.61 7 $86.53 $44.77 $30.88 $23.95 $19.80 $17.05 $15.09 B $36.99 345.23 $31.34 $24.41 $20.28 $17.53 $15.59 AER To estimate the required monthly payment amount for an installment toan, divide the amount to be borrowed by 1,000 and multiply the result by the appropriate rigure from the table. Suppose that you are repaying an automobile loan in the amount of $23,000. The rate of interost on the loan is 11%, and you have agreed to pay back the loan in 72 monthly payments Using the values in the preceding table, complete the following steps to calculate the required monthly payment amount for this loan using the values in the preceding table, complete the following steps to calculate the required monthly payment amount for this loan. Step 1: Divide the amount or the loan by 1,000. Dividing $23,000 (loan amount) by 1,000 gives you a value of Step 2: Use the rate of interest and the number of monthly payments to identify the appropriate figure to use from the table. In this case, the rate of interest is 19%, and the loan requires 72 monthly payments. Therefore, the relevant amount from the table iss Step 3: Multiply your answer from Step 1 by the appropriate value from the table cell (from Step 2). This gives you a required monthly payment amount of Calculate your total payments and Mnance charge by completing the following table. (Note: Enter al figures as positive numbers to two decima/ places.) 5 Total Payments Loon Amount Finance Charge $23,000.00 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts