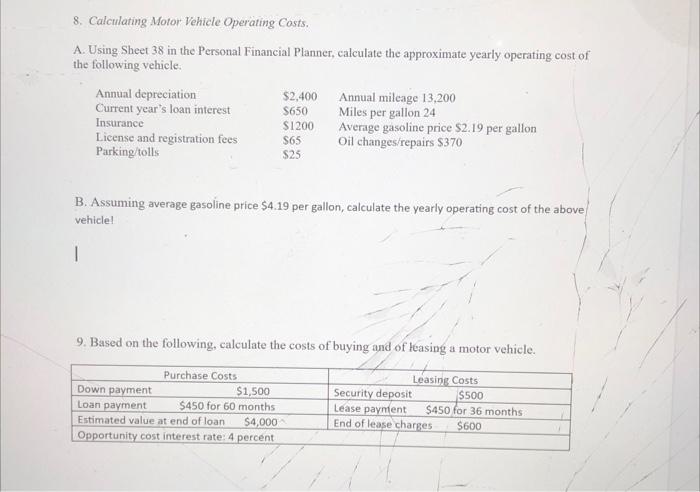

Question: 8. Calculating Motor Vehicle Operating Costs. A. Using Sheet 38 in the Personal Financial Planner, calculate the approximate yearly operating cost of the following vehicle.

8. Calculating Motor Vehicle Operating Costs. A. Using Sheet 38 in the Personal Financial Planner, calculate the approximate yearly operating cost of the following vehicle. Annual depreciation Current year's loan interest Insurance License and registration fees Parking/tolls B. Assuming average gasoline price $4.19 per gallon, calculate the yearly operating cost of the above vehicle! Down payment Loan payment $2,400 $650 $1200 $65 $25 9. Based on the following, calculate the costs of buying and of leasing a motor vehicle. Purchase Costs Annual mileage 13,200 Miles per gallon 24 Average gasoline price $2.19 per gallon Oil changes/repairs $370 $1,500 $450 for 60 months Estimated value at end of loan $4,000 Opportunity cost interest rate: 4 percent Leasing Costs $500 $450 for 36 months. $600 Security deposit Lease payment End of lease charges

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts